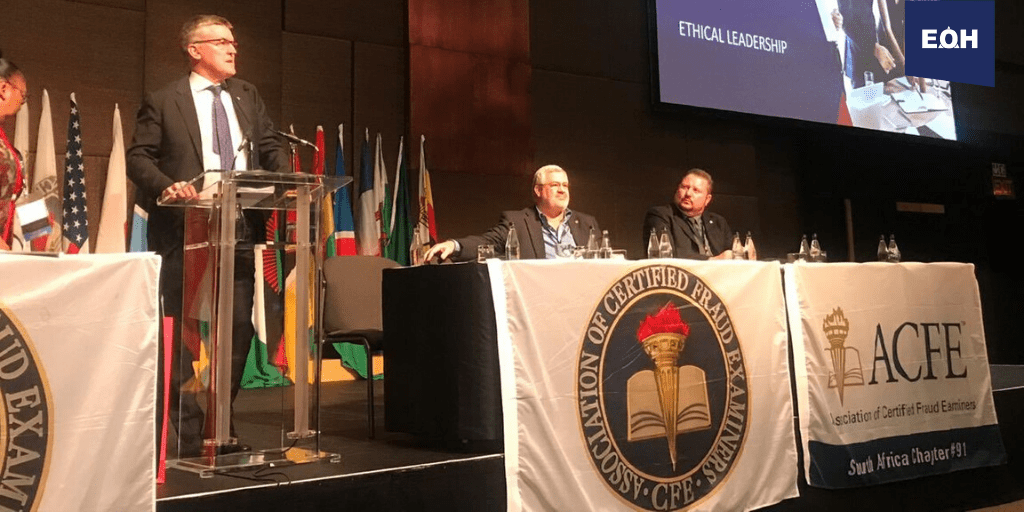

Alongside anti-fraud professionals from over 20 countries, our CEO Stephen van Coller and XTND CEO Servaas du Plessis addressed a packed hall at the 12th ACFE African and 21st Annual Fraud Conference, hosted by the Association of Certified Fraud Examiners (ACFE).

The conference, held over three days in September at the Sandton Convention Centre, is the largest anti-fraud event in Africa, and the second largest in the world. It brings together thousands of anti-fraud professionals to share leading-edge knowledge and explore available resources for fighting corporate malfeasance. Attendees included representatives from large accounting and law firms, insurance companies and banks; internal auditors; executive and operational managers; investigators in the public and private sectors; forensic specialists and consulting firms.

Servaas spoke on how to effectively manage occupational fraud, and began with the fascinating, and cautionary, tale of Crazy Eddie. Crazy Eddie was a chain of consumer electronics stores in the US, founded in 1971 by Eddie and Sam Antar.

At its peak, in the early 80s, Crazy Eddie had 43 stores and reported more than $300 million in sales. But in 1987, shortly after the company had been sold, it declared bankruptcy and was liquidated. The new owners had discovered that for almost the entire history of the business the Antar’s had been engaged in systematic, widespread and creative fraud: skimming income, misstating profits, money laundering and falsifying inventories.

What made the Crazy Eddie story unique was not its scale – it’s dwarfed by Enron, Tyco International and many others – but the fact that the fraud continued blatantly for eighteen years under the noses of auditors, employees and customers.

The evolution of the Crazy Eddie crime drama illustrates how petty and easily rationalised criminal infractions can escalate into serious and complex fraud without a thought given to concepts such as morality, ethics and justice. Eddie Antar was a charismatic leader who inspired his intensely loyal employees to follow a culture that nothing should go to the government. Sam Antar, one of the masterminds of the fraud, later warned: “Corporations don’t commit fraud, people commit fraud.”

Interestingly, in 2017 Sam Antar was interviewed and asked what he regarded as the biggest threat to him while he was committing the crimes. He replied: “The biggest threat was that a whistle-blower from within the company would inform the government of our crime. Lying to auditors, Wall Street analysts and journalists was easy.” As developers of ExposeIT, the ground-breaking whistle-blowing app, Servaas and XTND clearly took Sam Antar’s lesson to heart.

Stephen van Coller’s speech took place on the closing day of the conference to a packed hall. He opened his talk by sharing tips for preventing corruption, and concluded by introducing the concept of social cohesion, and the responsibility for each of us to play a role in strengthening the social fabric. “We’re too used to asking what the President is going to do, what our leaders are going to do, and not enough time spent thinking about what we’re going to do. If each one of us in this room committed to helping ten other South Africans – not today, but over the course of a lifetime – then that would be a significant accomplishment. And if that ethos was widespread, then there’d be no end to the impact that could be realised.”

Van Coller also shared some keys lessons that he has learnt with regards to corruption. These included: businesses aren’t corrupt; people are, complex corporate structures are at particular risk of corrupt practices, limited governance and compliance is an early indicator of possible corruption, culture trumps strategy every time, board independence is crucial, whistle-blowers should have efficient channels to expose corruption, don’t use middlemen, and lastly; If you don’t stand for something you stand for nothing.

Click HERE to view more EOH articles in our Quarterly magazine.