Stakeholder engagement

STAKEHOLDER ENGAGEMENT

EOH recognises the importance of proactive engagement with our key stakeholders and is committed to robust, consistent and transparent engagement. We define our stakeholders as those groups and individuals that are affected by our actions, whether directly or indirectly, and who affect the activities of the Group. Improving our understanding of their legitimate needs, interests and expectations provides input into how we approach our business activities, identifies risks and opportunities, and helps us to adapt to social, technological and regulatory changes.

Stakeholder engagement is one of our five governance objectives, which stem from the Board Charter and Board committee terms of reference and align with the EOH purpose, philosophies and values.

Responsibility for stakeholder engagement

Stakeholder engagement in the Group is overseen by the Social and Ethics Committee and material engagements are reported to the Board at each meeting. Interactions with stakeholders take place on both a formal and informal basis, are ongoing and conducted by the functions directly aligned with the stakeholder group. For example, employee engagements are mainly coordinated by the human resources department and engagements with clients include technical and operational staff.

EOH's approach to stakeholder engagement

In the context of sustained value creation for all its stakeholders, EOH's engagement with its stakeholders includes:

An inclusive approach: consultation with stakeholders in developing and achieving an accountable and strategic response to sustainability.

Materiality: determining the relevance and significance of issues to both the Group and its stakeholders. The materiality of issues concerns the legitimate interests and expectations of stakeholders in the context of the legal and strategic considerations of the business.

Responding appropriately to stakeholder issues through decisions, actions and performance, and communication.

Through ongoing and appropriate stakeholder engagements, EOH strives to inform, in an appropriate and timely manner, stakeholders of the implications and impacts of its activities in a fair and transparent manner. Also, to ensure that any disputes are resolved as effectively, efficiency and as expeditiously as possible.

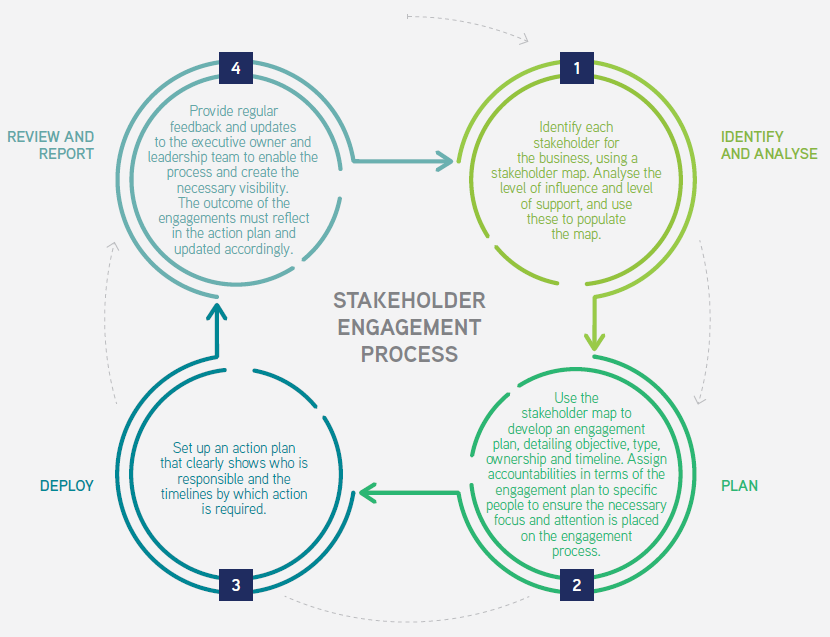

STAKEHOLDER ENGAGEMENT PROCESS

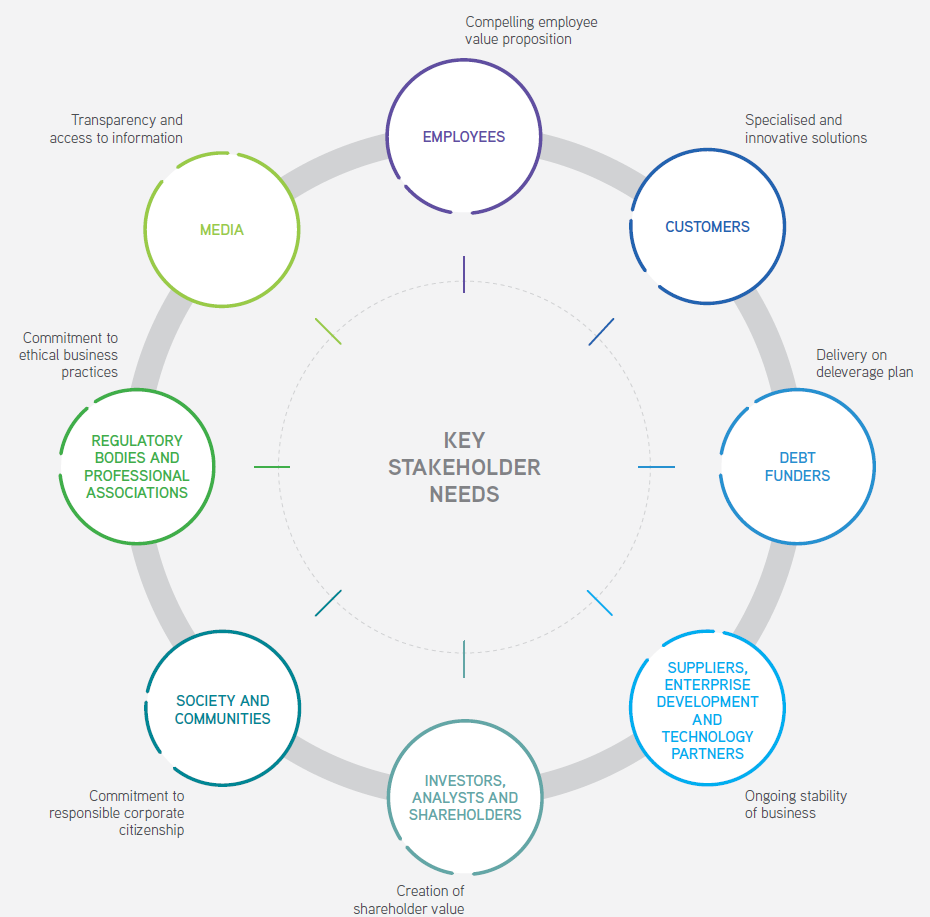

KEY STAKEHOLDER NEEDS

Our focus in the year ahead includes ongoing transparent communication

and engagement with all stakeholders on:

Our response to COVID-19 to ensure business continuity

Execution on our strategy

Roll-out of our recently launched employee value proposition

Instituting civil proceedings against individuals and businesses that were the perpetrators and benefactors of irregular and/or criminal conduct

Progress made towards reducing leverage

Supporting customers on their digital transformation journeys through COVID-19 and beyond

Significant engagements during the year include:

EOH continues to engage with our debt funders on an ongoing basis as part of our deleveraging strategy and focus on liquidity. Since August 2018, the Group has paid back R1.8 billion to lenders and in May 2020 paid R540 million in capital, exceeding the R500 million milestone scheduled for August 2020.

At EOH's annual general meeting in December 2019, 65% of shareholders present and eligible to vote voted against resolutions representing non-binding endorsement of EOH's remuneration policy and implementation report.

In line with the recommendations of King IV, the Remuneration Committee engaged with shareholders to ascertain the reasons for the dissenting votes and, as discussed in more detail in the Remuneration report, the remuneration policy and implementation report have been amended.

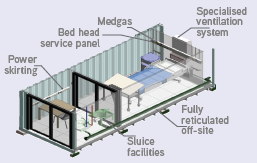

The development and deployment of EOH's ICUlate containerised ICU and isolation ward solution involved extensive engagement with provincial government departments, private hospitals, dental clinics and the government of Lesotho.

With healthcare systems under pressure as a result of rising infection rates due to COVID-19, this solution is ideally placed to ease that burden.

EOH contributed and responded to the call from Government, facilitated through industry associations, for input on how the economy and specifically the ICT industry could assist with and prepare for the many consequences of COVID-19 and the resultant lockdown.

EOH used its resources to create the Solidarity Fund website pro bono and to assist in other initiatives aimed at assisting society at large to survive the many consequences of the pandemic and lockdown.

We adopted a structured approach to communication and engagement with clients on governance remediation through Project FreeTrade through which we have successfully concluded all due diligence reviews with all major clients and have been cleared to continue doing business. Business as usual trade continued with an overwhelming majority of major clients, with no notable contracts or business being cancelled and all major clients re-opening full trading relationships based on our remedial actions and progress.

The shift to remote work and the implementation of pay cuts across the Group necessitated

This included weekly electronic meetings with the CEO, regular email communications, two surveys, a remote work playbook and weekly wellness interventions.

OUR INTERNAL ASSESSMENT OF THE QUALITY OF OUR RELATIONSHIPS

The section that follows shows EOH's key stakeholder groups, how we engage with them, their primary concerns during the period

and how we address those concerns.

Employees

Our employees are critical stakeholders that support the Group's ability to create value by developing and delivering our products and services to our customers.

| Quality of relationship: | Poor | Fair | Strong | |||

Key concerns include:

- Fair remuneration

- Health and safety during COVID-19

- Concern about reputational damage

- Questions relating to restructuring

- Fear of unfair reprisal or job loss

- Professional and personal development

- Career growth

- Empowerment

We address these concerns through:

- Providing a compelling employee value proposition

- Implementation of Group-wide standardised HR processes

- Greater transparency on people-related matters

- A focus on wellness, talent and retention

- Ongoing assurance of fair remuneration

- Proactive career and performance management

- Opportunities through corporatisation

Engagement channels:

- Weekly staff engagements led by the CEO

- Regular HR email communications

- Surveys, polls, consultations

- Employment equity forums

- Intranet

- People and culture Imbizo

- Mighty Networks

Customers

We sell our technology solutions to customers in a range of industries in the private and public sectors. Strong relationships with customers ensures the profitability and sustainability of our business.

| Quality of relationship: | Poor | Fair | Strong | |||

Key concerns include:

- Concern about reputational issues

- Questions about name change following launch of iOCO brand

- Assurance of ethical service and operations

- Continuity of service delivery

- Ongoing demand for ICT innovation

- Support to work remotely during COVID‑19

We address these concerns through:

- Engagement plans to ensure transparent and consistent communications

- Letter from ENSafrica assuring due diligence

- Remedial programme (Project FreeTrade)

- Nurturing ongoing relationships

- Quality assurance and certification programme

- Articulation of industry specific solutions

- Launch of iOCO brand supported by a strong digital presence and continuous engagements with customers

- Engaging customers on the transition to remote services and other digital solutions during COVID‑19

- Bringing over 70 COVID-19 solutions to market

Engagement channels:

- Personal communication from leadership

- Strategic and key account executives

- Customer engagement forums and events

- Customer service desks and support solutions

Debt

funders

Debt funders provide financial capital to fund the Group's activities. Given the high levels of leverage in the Group, the deleverage strategy has been a key focus area as the Group seeks to reduce debt funding to acceptable parameters.

| Quality of relationship: | Poor | Fair | Strong | |||

Key concerns include:

- Consistency of messaging and story

- Effectiveness of the current strategy

- Group financial position and performance

- Compliance with commitments under loan agreements

- Complexity and volume of legal requirements

We address these concerns through:

- Ongoing restructuring to leverage value

- Delivery on deleverage strategy ahead of schedule

- Transparent financial status reporting

- Independent assurance of future proofing

- Communication of capability building status

Engagement channels:

- All public sources of communication (SENS, website, client and staff comms)

- Monthly reporting forums

- Ad hoc lender meetings

- Facility agent

- Lenders technical advisor

- Legal counsel engagements

- Bilateral discussions

Suppliers,

enterprise

development

and

technology

partners

Suppliers, enterprise development and technology partners support the services and products we supply to our customers and ensuring good relationships with these stakeholders secures our ability to create value.

| Quality of relationship: | Poor | Fair | Strong | |||

Key concerns include:

- Potential reputational impact from partnering with EOH

- A lack of competitive bid process for suppliers to participate in opportunities within the EOH supply chain

- Unclear alignment within EOH businesses and multiple points of entry can create an inconsistent experience

- Lack of a clear policy or approach to Enterprise and Supplier Development (ESD)

- COVID-19 has affected the security and sustainability of the supply chain

We address these concerns through:

- Regular personal communication from leadership

- Letter from ENSafrica assuring due diligence

- Meetings with CEO and senior leadership

- Supplier and partnership agreements

- Roll out of a revised procurement policy that aligns with the Competition Act and other relevant regulations

- The restructuring exercise aligned to new Group strategy will create a simplified organisational structure with clear lines of engagement

- Central onboarding process and portal for supplier vetting and onboarding

- Development of a new ESD strategy and framework is in progress

- Initiatives are in place to standardise and stabilise the elements of the supply chain affected by COVID-19, driven through the internal IT teams and supported by legal and procurement

- Ongoing re-baselining of sales targets for the resale of OEM products

Engagement channels:

- Direct interactions with senior executives

- Public and private sector tenders

- Technology roadshows and conferences

- Business development service providers

- Existing supplier and technology partner relationships and engagement forums

- Webex, online portals etc.

Investors,

analysts and

shareholders

Investors and shareholders provide financial capital in the form of equity to fund the Group's activities and in return they expect a return on their investment. Analysts provide an opinion on the Group's prospects and can influence the attitudes of investors and shareholders towards the Group.

| Quality of relationship: | Poor | Fair | Strong | |||

Key concerns include:

- Deleverage strategy

- Ongoing sustainability of the business post-restructure

- Ability to navigate the current and lingering impacts of COVID-19

- Remuneration policy

- Key man risk

We address these concerns through:

- Regular, transparent communication of results

- Independent assurance of progress

- Demonstrating good progress in the deleverage strategy

- Review of the business unit strategies and presentation to the investor community to enable the market to have a clearer view of the direction of the business and how it aims to achieve its growth plans

- Cost saving initiatives were put in place at the beginning of the national lockdown to streamline costs when clients were under immense pressure. There is an ongoing focus on removing unnecessary costs and ensuring cost structures are as flexible as possible thereby reducing fixed costs

- Updated and revised remuneration policy

- Commitment from senior executives to completing the turnaround communicated in various forums

Engagement channels:

- Email queries

- Investor roadshows and one-on-one meetings

- JSE SENS announcements

- Investor conferences

- Annual General Meeting interactions

- Public relations media communications

- Annual Integrated Report

- Corporate website

Society and

communities

EOH's investments in socioeconomic development projects promotes development in communities and society, and is a fundamental component of our sustainable business strategy. It guides the Group in fostering and maintaining a true transformative culture with respect to B-BBEE, transformation and corporate governance.

| Quality of relationship: | Poor | Fair | Strong | |||

Key concerns include:

- Action to repair reputational issues

- Ongoing transformation and diversity

- Responsible corporate citizenship

- Commitment to ethical business

- Leadership of digital innovation

- Demand for job opportunities and growth

We address these concerns through:

- EOH Sustainability Strategy and Plan

- Internships

- Action to develop technology skills

- Contribution to community projects

- Enterprise development programmes

- EOH Courageous Leadership Series

Engagement channels:

- Media releases

- Ongoing engagements with project coordinators

Regulatory

bodies and

professional

associations

Government regulates business and a poor relationship with regulators can lead to the loss of our licence to operate. Industry bodies such as Business Unity South Africa (“BUSA”), Business Leadership South Africa (“BLSA”) and The South African Institute of Chartered Accountants (“SAICA”) provide opportunities for the sharing of good practice and provide a unified channel for communicating business’s requirements to government.

| Quality of relationship: | Poor | Fair | Strong | |||

Key concerns include:

- COVID-19 Regulations and the impact of the pandemic on the ICT industry

- Public Procurement Bill/Public Financial Management Amendment Bill

- Broad-Based Black Economic Empowerment Legislation

- Update and close off on the ENSafrica forensic investigation and related matters

We address these concerns through:

- EOH collaborated with Government and industry bodies to support the coordinated response to COVID-19

- Ongoing engagement with lawmakers via professional associations regarding the drafting of new legislation to improve governance and prevent fraud and corruption in the country. We also contributed to the research being conducted on the impact of the current B-BBEE legislation

- EOH continues to engage with the relevant regulatory and law enforcement bodies for the purposes of remediating the findings that came out of the ENSafrica forensic investigation and related matters

- Statutory and regulatory compliance

- Collaboration with professional associations

Engagement channels:

- Direct engagements with regulators in accordance with their requirements

- Professional engagements include ad hoc meetings such as task teams, workshops, industry-specific forums, surveys and written feedback on proposals and draft legislation

Media

Media coverage of the Group can have a material impact on our reputation and also represents an important information channel for our broader stakeholder base.

| Quality of relationship: | Poor | Fair | Strong | |||

Key media areas of interest include:

- New product solutions developed and launched

- Governance and reputation

- Strategy and performance

We address these interests through:

- Regular engagement with journalists by senior executives across EOH and iOCO to build an understanding of the business and its offerings. We actively drive product-related publicity campaigns with key trade media and our solutions are showcased on the EOH and iOCO websites

- Senior executives frequently engage journalists on governance milestones and respond timeously to requests for information, taking care to ensure understanding of issues and how we have tackled them

- Journalists are updated on strategy and performance through interviews, SENS announcements and press releases. All presentations are loaded on the EOH websites to ensure access to relevant information to all stakeholders

- Shaping public discourse with op-eds and through leadership articles by executives

Engagement channels:

- Interviews

- Media releases

- Editorials

- SENS announcements

- Corporate website