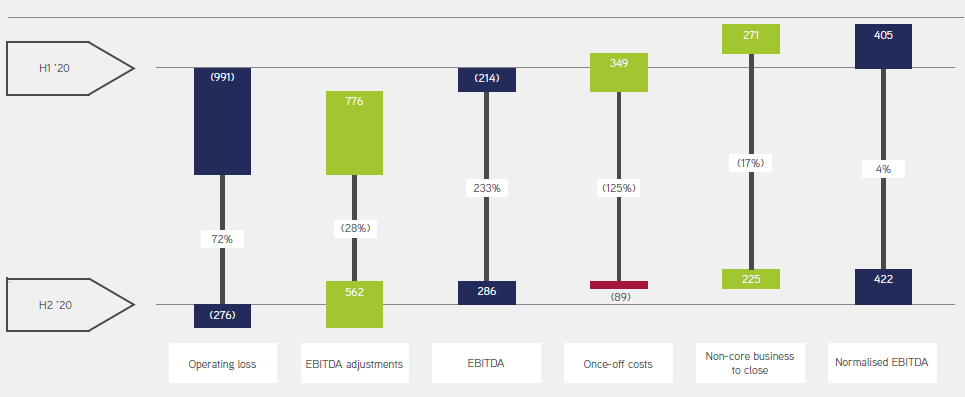

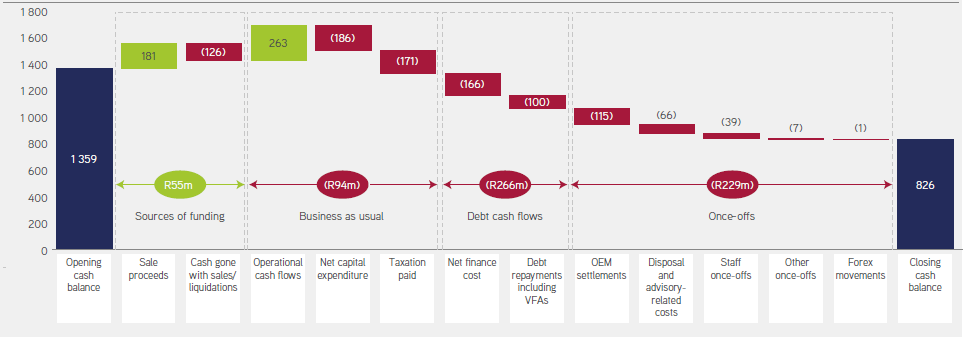

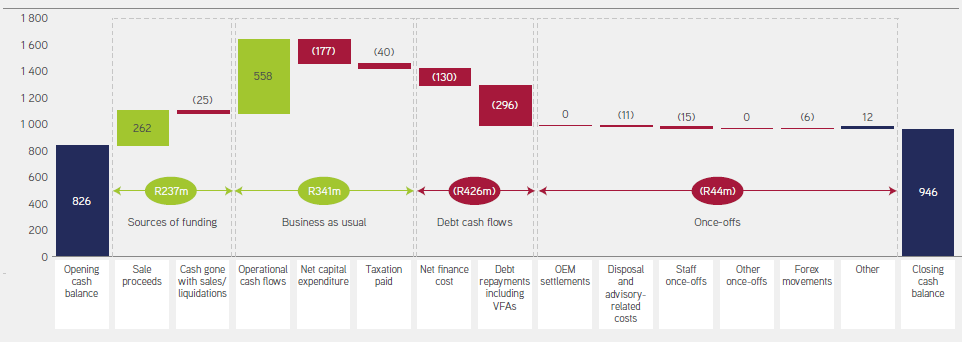

It has been truly exceptional. The impact of the pandemic has not only caused us to take significant steps to prevent lasting damage to our business, in particular to our workforce, but has also reinforced the potential of the Group to excel in an increasingly digitised world. In the second half, we have seen positive cash generation and positive EBITDA without normalisation adjustments, coupled with a significant improvement in the Group's liquidity position by the end of the reporting period.

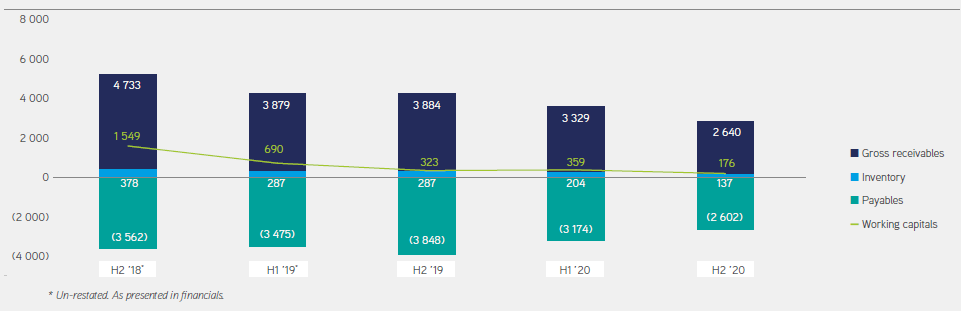

While COVID-19 has resulted in a weaker macroeconomic environment, the performance of the core iOCO business has remained relatively resilient. Revenue growth was impacted by businesses disposed of or closed during the current or prior year and the and the negative impact that the lockdown had on hardware sales. NEXTEC has been a very positive story and its position has improved significantly under the stewardship of Sean Bennett. NEXTEC revenue for the year did decline as a result of existing non-core and engineering, procurement and construction (EPC) type businesses. The IP portfolio came under some pressure and our B2B2C businesses were negatively impacted by the pandemic. EOH as a group, however, has clearly started to turn, which I think is a direct result of the tremendous work done to stabilise the business and create a solid foundation from which to grow. We are starting to see the green shoots resulting from that extensive effort.