Audit Committee's REPORT

For the year ended 31 July 2020

The EOH Audit Committee ('the committee') is pleased to submit its report for the year ended 31 July 2020, which has been approved by the Board. This report has been prepared in compliance with section 94(7)(f) of the Companies Act, No 71 of 2008 ('the Companies Act') and in accordance with the mandate given by the Board.

The Board is satisfied that the members of the committee have the necessary skills and experience to enable the committee to fulfil its duties.

The appointment of committee members will be subject to approval by shareholders at the next Annual General Meeting (AGM) to be held on Wednesday, 20 January 2021.

Committee purpose

The main role of the committee is to provide independent oversight of:

- the integrity of the annual financial statements and other external reports issued by the Company; and

- the effectiveness of the organisation's assurance services and functions, particularly focusing on combined assurance arrangements, the finance function, external assurance service providers and the internal audit function.

Terms of reference

The Board approved the new terms of reference for the committee during 2019, which are in line with the King IV Report on Corporate Governance for South Africa, 2016 ('King IV').

Meetings

Six meetings of the committee were held during the year under review.

The Chairman of the Board, the Chief Executive Officer, the Chief Financial Officer, the Chief Risk Officer, the Company Secretary and other members of senior management as required, attend committee meetings by invitation, but have no voting rights. Similarly, external and internal auditors attend committee meetings by invitation, but have no voting rights.

The Chairperson of the committee reports to the Board at all Board meetings on the activities and recommendations of the committee.

The Chairperson of the committee periodically meets separately with the external auditor and the internal audit executive without members of executive management being present.

Independence of the external auditor

Pursuant to a decision by the EOH Board to voluntarily comply with mandatory audit firm rotation prior to the prescribed date of 1 April 2023, the audit committee and the Board approved the appointment of PricewaterhouseCoopers Inc. (PwC) as external auditors at the annual general meeting in December 2019. The audit committee further confirms that it has assessed PwC's suitability for appointment in accordance with paragraph 3.84(g)(iii) of the JSE Listings Requirements and nominates for appointment PwC as the external auditor of EOH.

The committee has satisfied itself through enquiry that the external auditor is independent as defined by the Companies Act. The committee has considered the nature and extent of any non-audit services. During the 2020 fiscal year, fees in respect of non-audit services amounted to R4.5 million, which mainly related to tax services.

The committee met with the external auditor without management present to discuss the results of its audit and the overall quality of the Company's financial reporting. The committee also discussed the expertise, resources and experience of the Company's finance function with the external auditors.

The committee has agreed to the budgeted audit fee for the 2020 financial year. Auditors' remuneration is disclosed in note 26 to the consolidated annual financial statements. The committee is of the view that this remuneration is appropriate.

As required in terms of the JSE Listings Requirements, the committee has considered the information received from the auditors to allow the committee to assess the suitability for appointment of the audit firm and the designated audit partner. The committee has satisfied itself that the external auditors and the designated registered audit partner are accredited on the JSE list of auditors and advisers. The committee further confirms that it has assessed the suitability for appointment of the external auditors and the designated audit partner.

The committee has satisfied itself on the qualification and experience of the external auditor and is satisfied with the quality and level of the work performed by them.

Internal audit

EOH established an in-house internal audit function during the second half of the 2019 financial year. The internal audit charter and internal audit plan were approved by the committee and a Head of Internal Audit was appointed, who reports directly to the committee with an indirect line to the CRO. All internal audit reports were reviewed and discussed at committee meetings and, where appropriate, recommendations were made to the Board.

Combined assurance

Management has embarked on a project to assess the internal control environment and control activities, and to identify control weaknesses. Consequently, a roadmap towards a mature financial control framework by July 2021 has been designed. This plan has been independently assessed by internal audit.

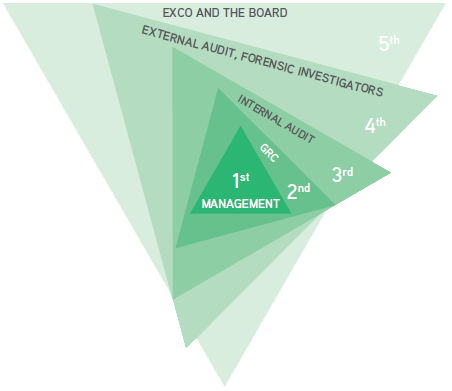

EOH's combined assurance model comprises five lines of defence. A combined assurance model incorporates and optimises all assurance services and functions to enable an effective control environment, to support the integrity of information used for internal decision-making by management, the governing body and its committees, and also supports the integrity of the organisation's external reports.

EOH’S COMBINED ASSURANCE MODEL

- 1st line (Management): Line managers own and manage risk, make business decisions and must carefully consider the risk of those decisions against the organisation's objectives.

- 2nd line (Governance, Risk and Compliance and other specialist teams): These functions create, implement, and manage systems, processes and procedures, and communications

- 3rd line (Internal auditor, investigations): Internal audit reviews and makes sure the work of line management and the specialist support teams is effective and appropriate, and also collect evidence. This role can be fulfilled by employees or third parties, but their goal is to provide independent and objective assurance to internal stakeholders like the board of directors and senior management.

-

4th line (a) External auditors, external actuaries, external fraud examiner: These external agencies usually provide assurance to external stakeholders like shareholders, government, and regulatory agencies.

4th line (b) Regulatory inspectors: Inspectors carry out reviews to assess compliance, provide reports from another perspective on the state of affairs, and provide additional assurance.

- 5th line (Executive committee and the Board of directors): Provide oversight on the implementation of combined assurance.

While the committee is satisfied with the level of assurance provided for significant Group risks, the combined assurance approach will continue to be enhanced during the 2021 fiscal year. The committee reviewed the plans and work outputs of the external and internal auditors as part of its responsibility to coordinate assurance activities.

Internally, management performed an attestation process throughout the organisation to ensure the right level of controls are in place from a financial statement reporting perspective. A number of internal control deficiencies were identified. These are dealt with by management in the ordinary course of business. Management will continue to monitor and resolve, where appropriate, IT access controls and segregation of duties conflicts, as the Group strengthens its current financial systems. The audit committee is, however, satisfied that none of these deficiencies had a material effect for the purposes of the preparation and presentation of the financial statements for the fiscal year under review.

Financial reporting

The committee reviewed the interim and Group annual financial statements, culminating in a recommendation to the Board to adopt them. The review of the results included ensuring compliance with International Financial Reporting Standards ('IFRS') and the acceptability of the Company's accounting policies. This includes the appropriate disclosures in the annual financial statements in accordance with IFRS as issued by the International Accounting Standards Board, IFRS Interpretations Committee ('IFRIC'), interpretations applicable to companies reporting under IFRS, SAICA Financial Reporting guides as issued by the Accounting Practices Committee, Financial Pronouncements as issued by the Financial Reporting Standards Council ('FRSC') and the requirements of the Companies Act and the JSE Listings Requirements.

In accordance with paragraph 3.84(g)(ii) of the JSE Listings Requirements, the committee confirms that the Company has established appropriate financial reporting procedures and that these procedures are operating effectively.

Audit qualification of 2019 opening balances

During the 2019 fiscal year, the current EOH management team identified a number of transactions that were processed incorrectly in both 2019 and prior periods. Management consequently processed adjustments as prior period errors if the facts that gave rise to the adjustment were found to clearly have existed in prior years. The audit committee accepted management's view and recommended to the Board the prior year adjustments, which has in turn approved the adjustments as part of the financial statements. The JSE responded by imposing a R7.5 million fine for these historic misstatements. This fine is accepted as an affirmation of the stance taken in 2019.

Expertise and experience of Group Chief Financial Officer and finance function

The committee reviewed the performance and expertise of Megan Pydigadu and confirmed her suitability to hold office as Group Financial Director in terms of the JSE Listings Requirements. The committee has also considered and has satisfied itself of the appropriateness of the expertise and experience of the finance function and adequacy of resources employed in this function.

Fraud prevention

An anonymous ethics line is in place which is managed by an independent party. All calls are reported in total anonymity.

Going concern status

The committee considered the going concern status of the Group on the basis of review of the annual financial statements and the information available to the committee and recommended such going concern status for adoption by the Board. The Board statement on the going concern status of the Group is contained in the directors' report and in note 1.2 to the consolidated annual financial statements.

In addition to the activities discussed in the rest of this report, the committee's key focus areas for the 2020 financial year included:

| Focus areas | Response |

| Assurance |

|

| Liquidity and solvency |

|

| Financial reporting |

|

Discharge of responsibilities

The committee is satisfied that it has conducted its affairs, discharged its legal and other responsibilities as outlined in its charter, the Companies Act and King IV. The Board concurred with this assessment.

Conclusion

The committee has had due regard to the principles and recommended practices of King IV in carrying out its duties and is satisfied that it has discharged its responsibilities in accordance with its terms of reference.

Mike Bosman

Chairperson, Audit Committee

1 December 2020