Remuneration report

INTRODUCTION

This Remuneration Report is presented in three parts, in line with the principles of King IV™ and the JSE Listings Requirements. It comprises a Background statement, a Remuneration Policy that provides context on the decisions and considerations taken during the year and an Implementation Report that discusses the implementation of the Remuneration Policy during the current year.

BACKGROUND STATEMENT

Remuneration philosophy

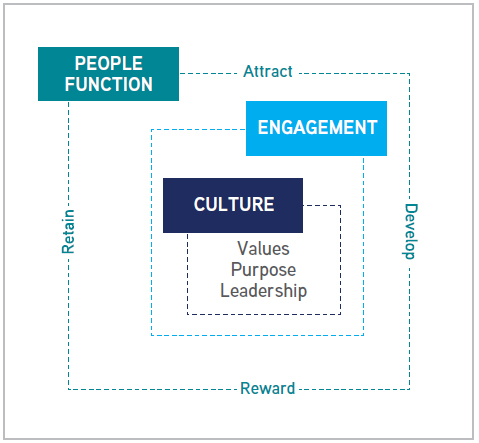

The Group’s compelling Employee Value Proposition (EVP) is a unique and comprehensive set of employer offerings that an employee receives in return for the skills, capabilities and experience they bring to EOH. Through the EOH EVP model, we seek to provide meaningful roles aligned with the business objectives, create an environment where employees can learn and grow, be recognised, be paid fairly, and ultimately cultivate brand ambassadors. Remuneration is only one offering within the EVP to attract and retain talent.

The EOH remuneration philosophy ensures a comprehensive and transparent remuneration strategy that drives a high-performing culture by supporting the delivery of the business strategy in a sustainable and ethical manner.

In determining remuneration that will be effective in achieving the goals of the Remuneration Policy and our human resource and Group strategy, we consider a range of internal and external factors. These include macroeconomic conditions, Group performance, retention strategies, industry performance, and input from our stakeholders, particularly the votes of our shareholders on the Remuneration Policy and implementation report at the annual general meeting.

The EOH Board is committed to engaging with shareholders in the event that the Remuneration Policy or implementation report, or both, are voted against by 25% or more of the votes exercised.

At the Annual General Meeting (AGM) on 5 December 2019 the Company did not receive the required number of votes in favour of the Remuneration Policy and the implementation report. The results of the voting at the previous two AGM’s were as follows:

| 5 December 2019 | 20 February 2019 | |||||||

| For | Against | For | Against | |||||

| Remuneration Policy | 34.64% | 65.36% | 74.79% | 25.21% | ||||

| Implementation Report | 34.64% | 65.36% | 65.25% | 34.75% | ||||

Although the Group extended an invitation to all shareholders to address their concerns on the Remuneration Policy and Implementation Report to the Chairperson of the Nomination and Remuneration Committee, no responses were received. The revised Remuneration Policy discussed below aims to align with good practice. EOH remains committed to engaging with shareholders so that their input can be considered in future revisions to the Remuneration Policy and Implementation Report.

External review of executive and senior management incentives

In the context of the significant change in the organisation over the last two years, the results of the voting at the AGM on 5 December 2019, and the Board’s commitment to review employee retention schemes, the Board retained Vasdex Remuneration Specialists (Vasdex) to review the Remuneration Policy, including executive and senior management incentives. The review identified several shortcomings in the existing schemes. These included that the short-term incentive was based on a profit-share model, which did not fully account for costs and affordability by the overall Group. Further, the long-term incentive was based purely on share price growth, which lost its relevance in terms of connecting to individual performance and, therefore, of limited value as a retention tool. In addition, the remuneration schemes were not consistently and transparently performance-based.

The review resulted in the formulation of a new approach to short- and long-term incentives that will be implemented at the end of the financial year 2020 with awards under the new share plan, being the 2020 EOH Share Plan (2020 Share Plan) commencing once shareholder approval for the 2020 Share Plan is obtained at the upcoming AGM. These incentive schemes contain financial and non-financial performance measures that are closely aligned to the EOH overall sustainable value-creating business strategy and contains specific divisional performance measure relating to the individual operating entities.

EOH’s approach to reward is holistic with the Remuneration Policy providing for a standardised remuneration governance structure in the Group that serves as a foundation to our employment ethos underpinned by the company strategy. The different operating entities in the Group have performance measures set in incentives for employees that are relevant for the entity and the Group, aligning individual KPIs with overall achievement of business strategy.

Based on its review of the Company and its key personnel, the Nomination and Remuneration Committee considers Vasdex to be independent and objective.

The committee is satisfied that the Remuneration Policy, as further detailed in this report, achieved its objectives during the year.

A primary area of focus for the Nomination and Remuneration Committee for the past year was to revise the Remuneration Policy to ensure Group-wide fair, responsible, and transparent remuneration in line with best practice.

As a focus area for 2021, a revised 2021 Remuneration Policy will be further enhanced with EOH’s position on:

- Principles for fair and responsible remuneration for executive management, in the context of overall employee remuneration and

- The basis for setting of fees for non-executive directors.

More information on the composition of the Nomination and Remuneration Committee, attendance, other key areas of focus during the year, and focus areas for the year ahead are available in the Nomination and Remuneration Committee Report

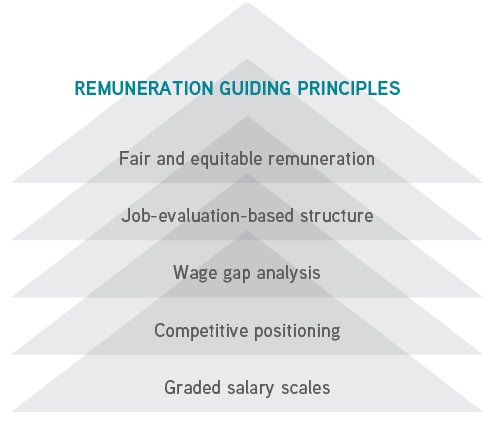

Job grading

The Group adopted the Willis Watson Towers Global Grading system, a method that determines the relative size and importance of jobs. The objective is to establish (as systematically and objectively as possible) the worth of one job relative to another to determine where jobs should be placed in the organisational structure.

Job evaluation is an integral part of the greater Human Resources offering and forms the foundation of the total remuneration strategy of the Group. An effective grade structure is established by means of a standardised objective tool used to evaluate and rank jobs in an impartial and consistent manner. It allows for equitable competitive remuneration and benchmarking; market alignment, improved recruitment, effective selection, and placement; ensuring focused training and development; and provide input into the performance management process where standards and performance requirements are individualised and contextualised for every employee.

Performance management

EOH has implemented a comprehensive performance management process with a supporting (digitised) key performance areas (KPA) system. Performance management is an integrated process of defining, measuring, supporting, improving, and rewarding performance.

Effective performance management in EOH is built on respect and translates into a high performing culture. The KPAs defined are critical to driving business sustainability and is cascaded down into the business. The objectives of the performance management process include;

- Improved individual, team and business performance.

- Aligned business, team, and individual objectives.

- Providing clarity so that everyone understands what is expected of them.

- Motivated employees and increase commitment.

- Underpinning the core values of EOH.

- Providing an objective basis for reward and recognition (monetary and non-monetary).

- Improved learning and career management.

- Improved dialogue and communication.

- Providing continuous improvement opportunities.

- Supporting culture-change.

REMUNERATION POLICY

The Remuneration Policy aims to support the achievement of the EOH business strategy and shareholder requirements by attracting, rewarding, and retaining the best possible talent for the business. The policy ensures fairness and internal equity through a standardised remuneration governance structure that is applied to all remuneration and incentive related practices and decisions. It aligns individual performance to business objectives and drives a high performing business culture while ensuring that the remuneration framework is in line with industry benchmarks. The policy promotes an ethical culture and responsible corporate citizenship within all of the Group’s activities and drives financial and non-financial business imperatives in a sustainable manner.

Remuneration across the Group is designed to reward within the income range associated with the applicable job profile and in accordance with market trends, qualifications, experience, knowledge, and performance of the employee. EOH structures remuneration in a manner that is fair and responsible between executives and employees, and takes into account levels of responsibility, accountability, competencies, institutional IP, performance, and scarcity of skills.

The Group uses salary benchmarks to determine market relatedness. Annual benchmarking is conducted against comparable firms in the market to assess market competitiveness and forms a primary input into the annual salary review process, which is, in all instances subject to affordability and the sustainability of the Group’s remuneration practices.

Salaries are reviewed each year in the context of macroeconomic factors, including CPI, market and trading conditions, skills shortages in specific areas, and salary surveys/benchmarks. Increases are considered based on market information, organisational performance, affordability, and changes in scope and roles. Increases are recommended by business unit leaders and approved by the Line of Business CEO, with line of sight provided to the Group CEO.

The Group CEO, CFO, and CRO are employed in executive employment contracts with a notice period of six months for the Group CEO and three months for the CFO and CRO. Other executive directors and senior management are employed in terms of standard employment contracts with a notice period of three months. All directors sign restraints of trade agreements for a minimum period of 12 months following their resignations as directors. There are no obligations in the executive employment contracts that give rise to payments on termination of employment or office.

We measure performance against our strategic objectives by monitoring predefined KPAs on a bi-annual basis. Performance is weighted by occupational level for KPA.

| KPA | Executive | Senior management |

Middle management |

Junior management/ skilled |

Semi-skilled/ unskilled |

|||||

| Business | 50% | 40% | 30% | 20% | 20% | |||||

| People | 25% | 35% | 35% | 20% | 0% | |||||

| Individual | 25% | 25% | 35% | 60% | 80% |

A new malus and clawback clause has been included in the Remuneration Policy, that is designed to give the Board the ability to adjust or clawback any incentives paid as part of short- or long-term incentives as a result of a breach of a material obligation such as a material misstatement of financials or a breach of the code of conduct that gives rise to reputational damage or legal action.

The full Remuneration Policy will be made available on our website at www.eoh.co.za , once the 2021 Remuneration Policy has been approved.

Remuneration structure

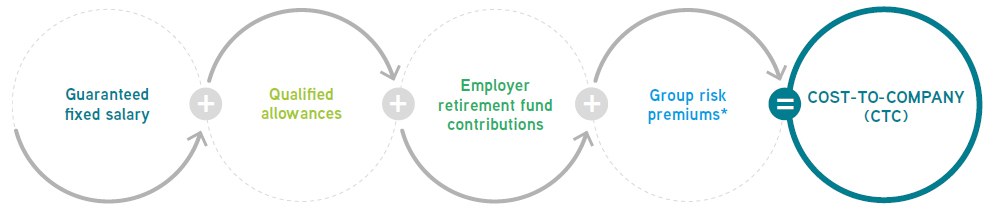

Total remuneration comprises the sum of:

- Total guaranteed package – also known as Cost-to-Company, which includes a guaranteed fixed salary and benefits.

- Short-term incentives (STIs) paid annually if short-term performance targets are achieved.

- Long-term incentives (LTIs) that vest over a three to five-year period, depending on the applicable LTI instrument.

Guaranteed package

EOH’s Cost-to-Company approach provides employees with flexibility and choice regarding compulsory benefits. The Cost-to- Company structure includes:

Cost-to-Company is guaranteed and normally paid irrespective of Group performance. EOH seeks to offer competitive remuneration relative to its peers, and remuneration is set at or close to the local market median, which allows for talent in EOH to be mobile and global remuneration market data is taken into account where applicable. Above-median remuneration may be offered where necessary to attract top talent, particularly in scarce and critical skills areas and to retain top talent. In rare instances, below-median remuneration is provided for people who display high performance but are new to their role and still need to grow fully into the role.

Total pay mix

A “job family” approach is used in determining pay mix using the organisational hierarchy to categorise jobs. A market-related variable pay-mix is assigned to each job family and split into STI and LTI. The STI percentage by job category is dependent on the line of sight, influence, and accountability, while the LTI percentage is assigned to different LTI instruments depending on the job category. LTIs are generally equity settled but can be cash-settled with the approval of the Nomination and Remuneration Committee, while STIs are generally cash-settled.

GUARANTEED PACKAGE

EOH’s Cost-to-Company approach provides employees with flexibility and choice regarding compulsory benefits. The Cost-to-Company structure includes:

* Ringfenced schemes may have different arrangements.

Short-term incentives (STI Plan)

The short-term incentive plan is designed to reward eligible employees for achievement against pre-determined KPAs during the year. It reinforces the alignment of individual KPAs with the overall achievement of the business strategy. Divisional executives, senior managers, and key employees may be selected by the EOH Board to be participants in the STI.

KPAs targets for the STI Plan are as follows, subject to the Governance, Risk and Compliance modifier:

EBIT achievement

Divisional and Line of Business earnings before interest and tax (EBIT) incentives are calculated from 80% of target to target on a linear basis. Above target, incentives are calculated on a pro-rata basis and capped at 150%. The cap applied remains at the sole discretion of the Company, and where necessary, Group Executive Management's discretion will be applied. Below 80% of the target, no bonus is payable.

Debtors Days and Cash Conversion

At least 80% of the budgeted EBIT number must be achieved before payment against debtors' days, and cash conversion is made.

Debtors days incentives include work in progress and revenue accruals. Incentives are calculated from target days + 10 days to 50% of target days on a pro-rata basis. At the targeted debtors' days + 10 days, no incentive is paid, while improving debtors days to 50% of the target achieves a 200% incentive.

Cash conversion incentives are calculated from 100% on a linear basis to the cap at 150%. The cash conversion is calculated by dividing the cash generated from operations by EBITDA. A cash conversion tracker will be made available in a Qlik App (business information reporting tool) to determine achievement at the relevant level during the year.

Transformation of Business (Bonus Impact Measurement)

The transformation score of the relevant Line of Business/Cluster is treated as a bonus impact measurement for the financial year. The score is calculated based on the percentage of Black (African, Coloured, and Indian) employees of the total Line of Business/Cluster headcount.

Should the agreed transformation target not be met, a 10% deduction is applied to the overall incentive payable. No additional incentive payment in lieu of overachievement of the agreed targets will be payable.

Consideration will be given to any impact on business due to potential selective rightsizing, sales of businesses, inter-company staff transfers, etc. which could have a direct impact on the targets as communicated. These instances will be reviewed on an individual basis, and Group Executive discretion will be applied.

Governance, risk and compliance (GRC) modifier

In line with good governance and corporate processes, employees must meet the following requirements, or no incentive is payable:

- Full compliance to all EOH Policies ensured within the employee's business area, including bid processes, disclosures, and sign-off requirements. A final determination is made by the Group CEO and CRO regarding policy non-compliance based on the degree of negligence/willful blindness by the employee, taking into account any appropriate remediation taken by the employee to intervene or stop negligence or non-policy compliance by the relevant employee or other employees, where applicable.

- All GRC compulsory training completed on time in the relevant LMS Portal, including those of direct employees (where applicable).

- All attestations completed and updated on the LMS Portal, including those of direct employees (where applicable).

STI Quantum (potential)

Employees in the STI Plan qualify for a percentage of their annual Cost-to-Company depending on the weighted KPI scoring in accordance with the performance metrics.

Payments in respect of an on-target incentive that have passed the GRC modifier are subject to overall EOH business performance and Nomination and Remuneration Committee approval. In addition, the employee:

- must be in the employ of EOH at the time that the incentive falls due for payment;

- must not be subject to any disciplinary action, misconduct, or forensic investigation;

- must not be subject to any enquiry relating to poor work performance; and

- must not have had their employment terminated or be in the process of serving their notice period.

Long-Term Incentive Plan (LTIP)

The LTIP aims to align divisional executives and management with the interests of the Group, to attract, retain, motivate and reward excellent performance by employees who are able to influence the performance of members of the EOH Group or divisions on a basis that aligns their interests with those of EOH shareholders and the business's strategy. The LTIP is available to divisional executives, senior managers, and key employees selected by the EOH Board to be participants in the LTIP.

Current retention schemes FY2020

The Group currently has three share schemes, the EOH Holding Company Share Participation Scheme (EOH Share Trust), the Mthombo Trust, and the Share Ownership Plan 2018 (2018 SOP).

The EOH Share Trust

The scheme is governed by a trust deed approved by shareholders and is a registered Schedule 14 Share Trust approved by the JSE Limited. The primary objective of the share trust is to retain highly skilled and talented individuals, and share options are only issued to high-performing individuals based on their contribution to the Group.

Under the terms of the EOH Share Trust, up to 18 million shares are reserved for share options, which are equity-settled. The option strike price is the share price on the trading day immediately preceding the date on which share options are offered, less a 40% discount. Share options vest in four equal annual tranches, with the first tranche of 25% vesting two years after the initial grant date. The next 25% vest after three years, 25% after four years, and the final 25% after year five. Vested share options will lapse ten years after the grant date. Should an employee leave EOH, their unvested share options are forfeited.

The last award made by the EOH Share Trust was in October 2018 and is expected to complete vesting in 2023. The EOH Share Trust will not form part of the future remuneration structure and will be terminated once the last award vests.

The Mthombo Trust

The scheme is governed by a trust deed approved by shareholders and is a registered Schedule 14 Share Trust approved by the JSE Limited. It is a B-BBEE scheme introduced to promote black economic transformation with the only participants being qualifying EOH employees. The option strike price is the share price on the trading day immediately preceding the date when share options are offered less a 40% discount.

Share options vest in three equal tranches, with the first tranche of 33.3% vesting three years after the initial grant date, 33.3% after four years, and the final 33.3% after year five. Vested share options will lapse eight years after grant date.

The last active awards are expected to conclude vesting in 2022. The Mthombo Trust is not expected to form part of the future remuneration structure.

The 2018 Share Ownership Plan (2018 SOP)

During 2018, the Company reviewed the two existing share option schemes, considering the context of local and global practice, shareholder feedback, and the pressing need to attract, retain, and engage critical talent. The outcome of this process was the 2018 SOP, which replaced the EOH Share Trust scheme as the Company's primary long-term incentive plan. The key objectives of this change were to ensure the attraction and retention of key individuals in the Company, to enable a sustainable succession planning strategy and to foster better alignment between executives, staff and shareholders.

The 2018 SOP provides employees with the opportunity of receiving shares in the Company through the award of conditional rights to shares, which vest over a period determined by the Nomination and Remuneration Committee, usually with the first tranche of 25% vesting two years after the initial grant date, 25% after three years, 25% after four years and 25% after year five. These awards are subject to continued employment and the achievement of Company performance conditions, where applicable.

Shares to settle 2018 SOP awards will be purchased in the market with no new shares are issued in settlement, and the scheme, therefore, has no dilutionary impact on shareholders. The Nomination and Remuneration Committee has the authority to direct that an award be cash settled by making payment of the value of the vested shares. Compared to the previous share option plan, the 2018 SOP awards are less volatile and dilutive, and more aligned with the creation of shareholder value (share price growth and dividends). Performance conditions will be linked to critical Company outcomes for which the Group's executives are accountable, including earnings growth, return on capital, cash flow, and key measures of sustainability

The 2018 SOP was used as follows:

Once-off awards of conditional shares were made to employees with unvested options under the EOH Share Trust and the Mthombo Trust to address immediate retention risks caused by the fall in the Company's share price by offering to replace employees' unvested options on a fair value exchange basis. Top-up awards were also granted to selected employees on a once-off basis. The 2018 SOP was also used to make annual awards to employees in line with market benchmarks.

The proposed EOH 2020 Share Plan (2020 Share Plan)

Following the review of the Company's existing incentive schemes by an external remuneration consultant, a new equity-settled share plan has been designed, which will be adopted subject to shareholder approval at the annual general meeting in January 2021.

Settlement is envisaged to be equity-settled for all elements, although the 2020 Share Plan does allow for either equity or cash settlement at the Board's discretion. Equity settlement can be via allotment and issue of new shares, the allocation of treasury shares, or the acquisition of shares in the open market on behalf of participants. The selection of the settlement method will aim to minimise equity dilution when settling the Share Plan as far as possible.

Any Executive Director, senior manager, Prescribed Officer and/or key employee of EOH or its subsidiaries may be selected by the Board to be eligible to become participants in the 2020 Share Plan.

The maximum number of shares in aggregate to be acquired by participants over the duration of the 2020 Share Plan is not to exceed 8.8 million shares, currently representing approximately 5% of EOH's issued share capital, and for anyone participant, not to exceed 1.7 million shares, currently representing approximately 1% of the issued share capital.

Allocations, awards, and grants will be governed by EOH's reward philosophy and strategy, taking into consideration, inter alia, a participant's current status, role, current remuneration, and the Remuneration Policy. The Remuneration Policy includes a malus/clawback clause that gives the Board the ability to adjust or clawback any incentives paid as part of STI or LTI as a result of a breach of material obligation.

The 2020 Share Plan comprises three elements:

| 1. | Hurdle Share Appreciation Rights (HSAR) |

| The intent of the HSAR is to incentivise eligible employees to guard against a decline in shareholder value, to recover and sustain shareholder value over a five-year time period. HSAR will vest no earlier than on the fifth anniversary of the allocation. On settlement, the value accruing to participants will be the appreciation of EOH's share price over and above a predetermined hurdle growth rate, but subject to the achievement of performance criteria. The above-hurdle appreciation in the underlying shares will be settled in shares, which shares may be, at the discretion of the Board, allotted and issued, or acquired and transferred to participants. Alternatively, a cash bonus of equivalent value may be paid. |

Hurdle Share Application Rights (HSAR)

Vesting no earlier than on the fifth anniversary of the allocation

Guard against decline in shareholder value

Appreciation of EOH share price over and above a pre-determined hurdle growth rate

| 2. | Performance Share (PS) |

The primary element for the long-term share-based incentivisation of Group executives (being predominantly executive directors, divisional and cluster executives, and prescribed officers) will be conditional awards. Each award will vest no earlier than three years from their award date to the extent that EOH meets specified performance criteria over the intervening period. The number of shares that vest will depend on whether EOH's performance over the intervening three-year period is on target, underperform, or outperforms the targets set at the award date. The performance criteria to govern the vesting of PS will be determined annually for each award by the Board and communicated in award letters to participants. Performance shares closely align the interests of shareholders and Group executives by rewarding superior shareholder and financial performance in the future. The target performance will be determined on an acceptable, expected, required performance and full maximum vesting at a truly excellent or upper-quartile and above performance. |

Performance Share (PS)

Vesting no earlier than on the third anniversary of the award

Conditional awards

Closely align the interest to shareholders

| 3. | Matching Restricted Shares (MRS) |

Under the MRS, conditional grants will be made to eligible employees. On vesting of a grant, a number of matching restricted shares may vest depending on the achievement of the performance criteria. It is the intention to develop and implement a minimum shareholding policy. The MRS will be used as a mechanism to enable Group executives to obtain a required minimum shareholding. |

Matching Restricted Shares (MRS)

Conditional grant

Vesting no earlier than on the third anniversary of the grant

Vesting results in settlement of matching restricted shares

Termination of employment

Treatment of benefits under the proposed scheme in the event of termination of employment depends on whether the termination is a 'no-fault' or 'fault' termination, as shown in the table below.

| No-fault termination | Fault termination | |

| Definition | No fault termination is the termination of employment of a participant by reason of:

|

Dismissal for misconduct, poor performance or a resignation by the participant. |

| Benefits in terms of Hurdle Share Appreciation Rights | All HSAR allocated but unvested, will be settled, unless the Board determines otherwise. | All HSAR allocated but not settled will be cancelled. |

| Benefits in terms of Performance Shares | Performance Shares will be prorated for the time period until the termination date and be further adjusted by a performance factor, which the Board may in its discretion apply relating to EOH's performance as at the termination date. | All Performance Shares will be cancelled. |

| Benefits in terms of Matching Restricted Shares | The MRS will be settled in full (alternatively pro-rated for time). | All MRS will be cancelled. |

COVID-19 and remuneration

Our guiding objective in navigating the crisis created by COVID-19 is to keep as many people employed as possible in the context of the economic and social hardships that undoubtedly lie ahead for all South Africans. Given the unprecedented times we find ourselves in, we need to implement stringent actions to manage the Company's liquidity and preserve jobs to keep us relevant and sustainable for the longer term.

To reduce monthly cash payments across the Group, we implemented a range of initiatives to reduce costs significantly and rapidly. These included:

- EOH Exco took a 25% pay cut for a three-month period;

- Employees earning R256 800 per annum and below were excluded from the pay cuts;

- All other employees who accepted a salary reduction took a 20% pay cut for two months and a 10% pay cut for a further month;

- All employees that were subject to pay cuts during this period are eligible to participate in the EOH COVID-19 Fund;

- Shares awarded through the EOH COVID-19 Fund will vest two years from the award date should the employee remain at EOH or was a good leaver as defined; and

- Each affected employee, regardless of salary level, received 2 890 shares.

| COVID-19 share allocation | Shares |

| Total affected employees | 2 788 |

| Total shares to affected employees (2 890 shares per employee) | 8 057 320 |

| Add: Fixed-term contractors' shares | 106 930 |

| Total shares accepted | 8 165 250 |

The EOH Covid-19 Fund

On 15 June 2020, employees who accepted a salary reduction as outlined above received an award of 2 890 shares, with a value of R9 537.00 at the then share price of R3.30. The executive directors did not participate in the award.

Non-executive Director remuneration

Non-executive Directors' remuneration is not currently covered in the Remuneration Policy but the below current practice will form part of the 2021 Remuneration Policy.

Non-executive Directors sign engagement letters with the Company, which set out their duties and remuneration terms. The term of office of Non-executive Directors is governed by the memorandum of incorporation (MoI), which provides that directors who have served for three years will retire by rotation.

The remuneration of Non-executive Directors is reviewed annually by the Nomination and Remuneration Committee, which makes recommendations to the Board for approval.

Remuneration is compared with that of selected peer companies and is market-related. A review of current market practice in terms of the remuneration philosophy and remuneration payable to Non-executive Directors was undertaken during the year under review based on an appropriate comparator group of similar sized organisations in the information technology (IT) industry.

Non-executive remuneration is paid monthly, based on an annual retainer fee and a fee paid per meeting. Fees are typically approved annually on this basis at the Annual General Meeting (AGM).

IMPLEMENTATION REPORT

The Implementation Report explains how the Remuneration Policy was applied during the year under review. The Remuneration Policy was implemented across the Group at all levels, rewarding excellent performance to ensure the retention of key talent and high performers while appropriately addressing poor performance.

Executive Directors

The remuneration structure for the Executive directors for the financial year 2020 had targets based on the requirement to:

- ensure EOH remained solvent;

- complete the clean-up of the balance sheet;

- complete the ENSafrica review unfettered; and

- ensure the new compliance regime was implemented.

These outcomes were seen as critical to ensuring the survival of EOH. This meant the targets had to be set in a manner that did not conflict the Executive Directors in any way in achieving these key outcomes.

Based on outcomes required by Board the following key performance areas were agreed:

- EOH remains a going concern on 31 July 2020 as agreed by the external auditors;

- Net debt is less than R1.5 billion on 31 July 2020;

- Improvement in the risk matrix status and completion of the risk heat map by the business unit;

- Unqualified audit report for 31 July 2020;

- Enhance quality and timing of reporting to the Board including sub-committees;

- Enhanced finance systems in place for budgeting and consolidation;

- Timeous and complete financial reporting on a quarterly basis;

- 90% of required staff complete risk and governance training; and

- 90% of required staff complete declarations of conflict of interest and outside business interests.

The Nomination and Remuneration Committee recognises that these criteria are not the standard set of deliverables for a listed company but believed they were absolutely appropriate for the circumstance EOH found itself in, unrelated to the existing Board. It strongly believes these criteria were the most prudent in ensuring shareholder value was protected.

The remuneration outcomes for FY2019 and FY2020 are shown in the tables below:

| Stephen van Coller (appointed 1 September 2018) Awarded for 2020 |

|||||

| R000 | 2019 | 2020 | |||

|---|---|---|---|---|---|

| 1 | Fixed remuneration | 5 026 000 | 8 000 000 | ||

| 2 | COVID-19 salary adjustments | (500 000) | |||

| Short-term incentives (STI) | 4 000 000 | 4 000 000 | |||

| STI (Non-performance-related) | 4 000 000 | 4 000 000 | |||

| 3 | STI (Performance-related) | ||||

| 4 | LTI awarded | 6 000 000 | |||

| Other salary expenses allowed | 62 240 | ||||

| Total reward | 9 026 000 | 17 562 240 | |||

| 5 | Once-off buy-out | 10 000 000 | |||

| Total reward (including once-off buy-out) | 19 026 000 | 17 562 240 | |||

| Stephen van Coller (appointed 1 September 2018) Single figure remuneration for 2020 |

||||||

| R000 | 2019 | 2020 | ||||

|---|---|---|---|---|---|---|

| 1 | Fixed remuneration | 5 026 000 | 8 000 000 | |||

| 2 | COVID-19 salary adjustments | (500 000) | ||||

| Short-term incentives (STI) | 4 000 000 | 4 000 000 | ||||

| STI (Non-performance-related) | 4 000 000 | 4 000 000 | ||||

| 3 | STI (Performance-related) | |||||

| 4 | LTI vested | – | – | |||

| Other salary expenses allowed | 62 240 | |||||

| Total reward | 9 026 000 | 11 562 240 | ||||

| 5 | Once-off buy-out | 10 000 000 | ||||

| Total reward (including once-off buy-out) | 19 026 000 | 11 562 240 | ||||

| 1 | Cost-to-Company, which includes a guaranteed fixed salary and benefits |

| 2 | Pay cut |

| 3 | STI payable FY2021, which is derived from the performance for the year ended 31 July 2020, subject to Board approval |

| 4 | On 13 November 2018, 1 000 000 share options were awarded at a strike price of R19.00. On 19 December 2019, 452 830 shares were awarded at a price of R13.25 per share |

| 5 | On 13 November 2020, 250 000 share options will be exercisable. As the strike price was R19.00 per option, the realisable value is likely to be zero |

| 6 | Includes previous employer buy-out of bonus contract |

| Note: | R3 000 000 bonus was earned and approved by the Board but was declined by the Group CEO. |

| Megan Pydigadu (appointed 15 January 2019) Awarded for 2020 |

|||||

| R000 | 2019 | 2020 | |||

|---|---|---|---|---|---|

| 1 | Fixed remuneration | 2 201 000 | 4 500 000 | ||

| 2 | COVID-19 salary adjustments | (281 250) | |||

| Short-term incentives (STI) | 2 000 000 | 4 000 000 | |||

| STI (Non-performance-related) | 2 000 000 | 2 000 000 | |||

| 3 | STI (Performance-related) | 2 000 000 | |||

| 4 | LTI awarded | 2 000 145 | – | ||

| Other salary expenses allowed | 52 645 | ||||

| Total reward | 6 201 145 | 8 271 395 | |||

| Megan Pydigadu (appointed 15 January 2019) Single figure remuneration for 2020 |

|||||

| R000 | 2019 | 2020 | |||

|---|---|---|---|---|---|

| 1 | Fixed remuneration | 2 201 000 | 4 500 000 | ||

| 2 | COVID-19 salary adjustments | (281 250) | |||

| Short-term incentives (STI) | 2 000 000 | 4 000 000 | |||

| STI (Non-performance-related) | 2 000 000 | 2 000 000 | |||

| 3 | STI (Performance-related) | 2 000 000 | |||

| LTI vested | – | ||||

| Other salary expenses allowed | 52 645 | ||||

| Total reward | 4 201 000 | 8 271 395 | |||

| 1 | Cost-to-Company, which includes a guaranteed fixed salary and benefits |

| 2 | Pay cut |

| 3 | STI payable FY2021, which is derived from the performance for the year ended 31 July 2020, subject to Board approval |

| 4 | On 15 January 2019, 62 020 share were awarded at a share price of R32.25 per share |

| Fatima Newman (appointed 31 July 2019) – Prescribed Officer Awarded for 2020 |

|||||

| R000 | 2019 | 2020 | |||

|---|---|---|---|---|---|

| 1 | Fixed remuneration | 1 334 000 | 4 100 000 | ||

| 2 | COVID-19 salary adjustments | (256 250) | |||

| Short-term incentives (STI) | 4 000 000 | 4 000 000 | |||

| STI (Non-performance-related) | 4 000 000 | 2 000 000 | |||

| 3 | STI (Performance-related) | 2 000 000 | |||

| LTI awarded | – | ||||

| Other salary expenses allowed | 6 762 | ||||

| Total reward | 5 334 000 | 7 850 512 | |||

| 4 | Once-off buy-out | 3 000 000 | |||

| Total reward (including once-off buy-out) | 8 334 000 | 7 850 512 | |||

| Fatima Newman (appointed 31 July 2019) – Prescribed Officer Single figure remuneration for 2020 |

|||||

| R000 | 2019 | 2020 | |||

|---|---|---|---|---|---|

| 1 | Fixed remuneration | 1 334 000 | 4 100 000 | ||

| 2 | COVID-19 salary adjustments | (256 250) | |||

| Short-term incentives (STI) | 4 000 000 | 4 000 000 | |||

| STI (Non-performance-related) | 2 000 000 | 2 000 000 | |||

| 3 | STI (Performance-related) | 2 000 000 | 2 000 000 | ||

| LTI vested | – | ||||

| Other salary expenses allowed | 6 762 | ||||

| Total reward | 5 334 000 | 7 850 512 | |||

| 4 | Once-off buy-out | 3 000 000 | |||

| Total reward (including once-off buy-out) | 8 334 000 | 7 850 512 | |||

| 1 | Cost-to-Company, which includes a guaranteed fixed salary and benefits |

| 2 | Pay cut |

| 3 | STI payable FY2021, which is derived from the performance for the year ended 31 July 2020, subject to Board approval |

| 4 | Includes previous employer buy-out of bonus contract |

| * | Prescribed Officer |

Short-term incentives

Based on outcomes required by Board the following key performance areas were agreed for short-term incentive payment:

| Key performance area (KPA) Stephen van Coller |

KPA weighting (%) |

Award opportunity (R'000) |

Achievement % |

STI award (R'000) |

| EOH remains a going concern at 31 July 2020 | 20 | 600 | 100 | 600 |

| Net debt is less than R1.5 billion at 31 July 2020 | 20 | 600 | 100 | 600 |

| Improvement in the risk matrix status and completion of the risk heat map | 20 | 600 | 100 | 600 |

| Unqualified audit report for 31 July 2020 | 20 | 600 | 100 | 600 |

| Enhance quality and timing of reporting to the Board including sub-committees | 20 | 600 | 100 | 600 |

| Total | 100 | 3 000 | 3 000 |

| Note: While the Group CEO achieved 100%, he declined the award. |

| Key performance area (KPA) Megan Pydigadu |

KPA weighting (%) |

Award opportunity (R'000) |

Achievement % |

STI award (R'000) |

| EOH remains a going concern at 31 July 2020 | 20 | 400 | 100 | 400 |

| Net debt is less than R1.5 billion at 31 July 2020 | 20 | 400 | 100 | 400 |

| Enhanced finance systems in place for budgeting and consolidation | 20 | 400 | 100 | 400 |

| Unqualified audit report for 31 July 2020 | 20 | 400 | 100 | 400 |

| Timeous and complete financial reporting on a quarterly basis | 20 | 400 | 100 | 400 |

| Total | 100 | 2 000 | 2 000 |

| Key performance area (KPA) Fatima Newman |

KPA weighting (%) |

Award opportunity (R'000) |

Achievement % |

STI award (R'000) |

| EOH remains a going concern at 31 July 2020 | 25 | 500 | 100 | 500 |

| Improvement in the risk matrix status and completion of the risk heat map | 25 | 500 | 100 | 500 |

| 90% of required staff complete risk and governance training | 25 | 500 | 100 | 500 |

| 90% of required staff complete declarations of conflict of interest and outside business interests | 25 | 500 | 100 | 500 |

| Total | 100 | 2 000 | 2 000 |

As previously mentioned, the Nomination and Remuneration Committee recognises that these criteria are not the standard set of deliverables for a listed company but believes they were absolutely appropriate for the circumstances EOH found itself in and were the most prudent in ensuring shareholder value was protected.

These principles were based directly on the agreed Remuneration Policy as it relates to:

- Supporting the achievement of the EOH business strategy and shareholder requirements.

- Attracting, rewarding, and retaining the best possible talent for the business.

- Ensuring that the remuneration framework is in line with industry benchmarks.

- Driving financial and non-financial business imperatives in a sustainable manner.

Long-term incentives

On joining EOH as CEO on 3 September 2018, Stephen van Coller was given an option to purchase 1 000 000 EOH shares through The Share Trust at a strike price of R19. At the time the employment contract was concluded, Stephen van Coller was faced with a business in distress as a result of unresolved corruption issues, which lead to the EOH share price dropping significantly. It is estimated that the realisable value of the 1 000 000 share option over the next two years will have a zero value.

Megan Pydigadu was awarded 62 020 share options on joining EOH as CFO in FY2019, which were granted on 15 January 2019. These shares will vest in four equal tranches on 15 January 2021, 2022, 2023, and 2024, respectively.

During FY2020, Stephen van Coller was awarded 452 830 shares on 19 December 2019 at a price of R13.25 per share. These shares will vest in four equal tranches equally on 1 August 2021, 2022, 2023, and 2024, respectively, based on continued employment and share price performance on each vesting date.

Unvested awards and cash flow

| Number of shares | ||||||||||

| 15 June 2020 | Scheme | Award date | Opening balance on 1 August 2019 |

Granted during 2020 |

Exercise during FY2021 |

Exercise after FY2021 |

Forfeited during 2020 |

Vested during 2020 |

Closing balance on 31 July 2020 |

Face value on 31 July 2020**** |

| Executive Directors | ||||||||||

| Stephen van Coller | Share Trust* | 13 November 2018 | 1 000 000*** | 250 000 | 750 000 | – | – | 1 000 000 | – | |

| Share Ownership Trust** | 19 December 2019 | 452 830 | – | 452 830 | – | – | 452 830 | 2 200 754 | ||

| Subtotal | 1 000 000 | 452 830 | 250 000 | 1 202 830 | – | – | 1 452 830 | 2 200 754 | ||

| Megan Pydigadu | Share Ownership Plan | 15 January 2019 | 62 020 | 15 505 | 46 515 | – | – | 62 020 | 301 417 | |

| Subtotal | 62 020 | – | 15 505 | 46 515 | – | – | 62 020 | 301 417 | ||

| Total | 1 062 020 | 452 830 | 265 505 | 1 249 345 | – | – | 1 514 850 | 2 502 171 | ||

| * | The EOH Share Trust |

| ** | The 2018 Share Ownership Plan (SOP) |

| *** | 1 000 000 share options were awarded at a strike price of R19 |

| **** | Based on closing price as at 31 July 2020 of R4.86 |

No payments were made on termination of employment or office during the year.

Remuneration for FY2021

In determining the executive director's remuneration for FY2021, benchmarks that take into account the level and complexity of the role, job grade, and organisational parameters such as the size, type, and structure of EOH were considered.

It is envisaged that LTI allocations will be made under the 2020 Share Plan that is still subject to shareholder approval at the upcoming annual general meeting. Following approval of the 2020 Share Plan, any LTI allocations, will be linked to long-term performance measures, weightings, and achievement levels determined by the Remuneration and Nomination Committee and approved by the Board.

In accordance with the malus/clawback clause set out in the Remuneration Policy, any incentive will be subject to the executive guaranteeing and undertaking that they have not been involved personally, whether directly or indirectly, nor involved EOH in any incident or action that might impact negatively on or cause reputational damage to EOH.

| Megan Pydigadu | Fatima Newman | Stephen van Coller | Megan Pydigadu | Fatima Newman | Stephen van Coller | |||||||||

| Key performance area (KPA) | KPA weighting (%) | Note | ||||||||||||

| Financial performance | ||||||||||||||

| Refinance the debt and stabilise the capital structure by 31 July 2021 in prevention of over indebtedness |  |

|

40 | 20 | 40 | |||||||||

| Meet the normalised EBITDA and PAT targets as budgeted for 2021 |  |

|

|

|||||||||||

| Business sustainability | ||||||||||||||

| Significant progress in considering and simplifying divisions in the Group |  |

|

|

|||||||||||

| Finalise the disposal plan in line with the capital structure requirements and market conditions |  |

|

||||||||||||

| Significant progress on implementation of the new ERP system |  |

|

20 | 20 | 20 | |||||||||

| The order to cash and procure to pay processes have been mapped and have agreement and sign off by business |  |

|

||||||||||||

| Complete the cash pooling arrangements |  |

|||||||||||||

| Unqualified audit opinion |  |

|

|

|||||||||||

| Significant progress on getting tax findings and AFS up to date |  |

|

||||||||||||

| Social goals | ||||||||||||||

| Improve race and gender profile expressed in levels of seniority and remuneration status |  |

|

||||||||||||

| Improve race and gender profile based on an approved transformation plan |  |

|

||||||||||||

| Complete an approved transformation plan for the business |  |

|

||||||||||||

| Progress demonstrated on implementation of HRaaS |  |

|

20 | 30 | 20 | 1 | ||||||||

| Show improved performance 10% year-on-year against FY20 baseline EVP results |  |

|

|

|||||||||||

| Succession planning in place across the organisation |  |

|

|

|||||||||||

| Learning and Development EVP plan approved and implementation on track |  |

|

||||||||||||

| CSI plan approved and implemented on track |  |

|

|

|||||||||||

| Governance and risk | ||||||||||||||

| 90% completion on training and declarations |  |

|

|

|||||||||||

| Improvement shown on critical risk items identified |  |

|

||||||||||||

| Accurate and timeous close out on audit findings |  |

|

|

20 | 30 | 20 | 2 | |||||||

| Accurate and timeous close out on Risk Committee actions |  |

|

|

|||||||||||

| Accurate and timeous close out on Social and Ethics Committee actions |  |

|

|

|||||||||||

| Total | 100 | 100 | 100 | |||||||||||

| Notes | |

| 1 | Megan Pydigadu: Split 10% EOH and 10% finance team |

| Fatima Newman: Split 15% EOH and 15% CRO team | |

| 2 | Megan Pydigadu: Split 10% EOH and 10% finance team |

| Fatima Newman: Split 15% EOH and 15% CRO team | |

|

Targets are set at threshold (80%), on-target (100%) and stretched (120%) and will be applicable on each KPA and will be tallied per KPA to give the average achievement. |

Non-executive Director fees

Non-executive Director fees are reviewed by the Nomination and Remuneration Committee and the Board and proposed to shareholders for approval at the annual general meeting. Fees paid to non-executive directors during 2020 are shown in the table below and the proposed fees for FY2021 are set out in the notice of annual general meeting.

| Directors fees FY2020 (R'000) |

Directors fees FY2019 (R'000) |

|||

|---|---|---|---|---|

| Sipho Ngidi (appointed effective 20 February 2020) |

522 | |||

| Xolani Mkhwanazi (deceased 4 January 2020) |

333 | 134 | ||

| Jesmane Boggenpoel | 1 360 | 775 | ||

| Ismail Mamoojee | 1 389 | 797 | ||

| Moretlo Molefi | 1 019 | 494 | ||

| Anushka Bogdanov (resigned 28 July 2020) |

1 004 | 166 | ||

| Andrew Mthembu | 1 265 | 131 | ||

| Mike Bosman | 1 594 | 156 | ||

| Andrew Marshall (appointed 21 May 2020) |

139 | |||

| Asher Bohbot (resigned 28 February 2019) |

– | 1 372* | ||

| Pumeza Bam (resigned 12 July 2019) |

– | 607* | ||

| Tshilidzi Marwala (resigned 28 February 2019) |

– | 157 | ||

| Rob Sporen (resigned 28 February 2019) |

– | 193 |