My primary role as CEO is still to corporatise and formalise the business, rebuild confidence and return value to all our stakeholders. Having completed a more detailed strategic review and testing our new operating model we will continue to rebuild the Company.

The past 12 months have been very difficult for EOH. We have spent extensive time focusing on cleaning up the business, both from a governance and financial perspective as well as understanding the Group's strategic capabilities. I have been impressed by the spirit of my colleagues who have worked tirelessly during this challenging period. While there is still much to do, the path is much clearer.

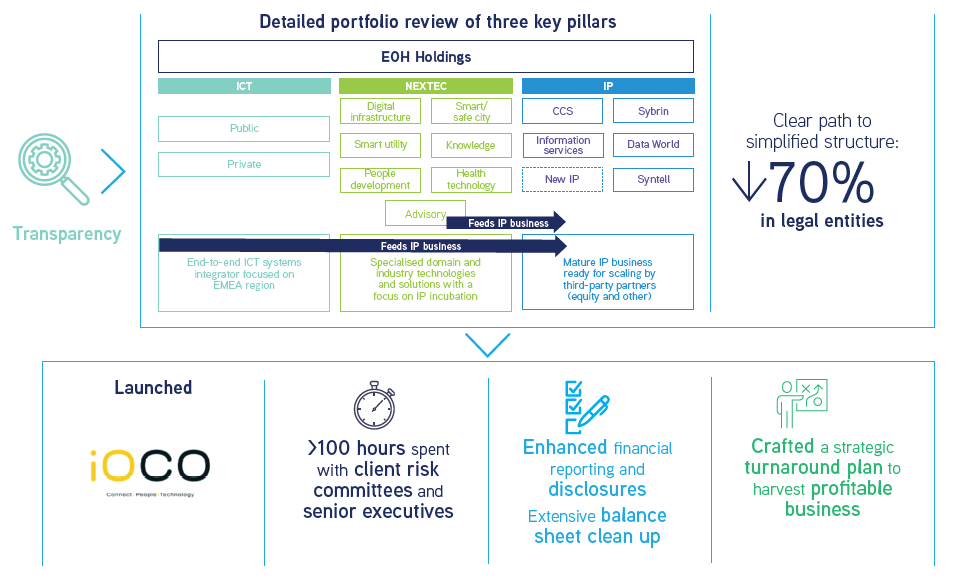

In the short term we will focus on continuing to deleverage our balance sheet while implementing governance changes and over the longer term we remain steadfast in a vision of a more synergised and focused offering that is well positioned to take advantage of the next wave of change in the ICT industry.

We will invest heavily in the sales and advisory function of the business to protect the client base and continue to build on our strengths in providing a one stop shop for all clients' needs. This is being driven through a plan to manage client concerns and generating robust, sustainable pipelines. The goal is to drive up productivity and protect business for the next stage.

We will invest in the core businesses of the solutions development which provide the foundation for the future in our key businesses lines of App Development, Data, Cloud and Security. Our traditional Technology business in iOCO will continue to leverage its legacy products and services.

Following a deep dive of our NEXTEC business there are questions on the scalability of these businesses as well as the capital structure requirements which may not be able to be accommodated given our current financial situation. Most of these businesses are undergoing a reassessment to determine next steps.

We will continue to refine our portfolio of assets, create liquidity events, and exit non-core businesses. We will pursue strategic sales to scale and grow businesses in partnership with the right investment partners as in the CCS transaction where we entered into a partnership with German firm, RIB.

As CEO I am deeply thankful to our clients who have stayed the course with us. I am also grateful to our Board of directors, my EXCO and all the EOH employees who continue to serve clients with excellence and integrity. As one of the largest technology businesses on the continent, there is significant value in the EOH business and we must not let these headwinds discourage or taint our potential.

This has been a difficult time for the EOH business but we will continue the process of meaningful engagement with all our stakeholders. The new EOH, which is transparent, rich in dialogue and an ethical environment where employees can innovate and grow, has begun to take shape.

I am looking forward to the 2020 year where we can build and grow strategically.