report

Segmental report

SALES & ADVISORY

- Go-To-Market

- Solutioning

2% of revenue

iOCO SERVICES

- Network Solutions

- Management & Operate

- Digital Industries

- Knowledge Process Outsourcing

29% of revenue

iOCO TECHNOLOGY

- Computer Software Reseller

- Enterprise Applications

- Computer Hardware Reseller

45% of revenue

iOCO DIGITAL

- Application Development

- Data Analysis

- Cloud & Security

- International

- Automation

24% of revenue

| FY2021 | FY2020 | ▲ | |

| Gross revenue (R’000) | 5 212 611 | 6 922 562 | (25%) |

|---|---|---|---|

| Gross profit | 1 386 820 | 1 684 352 | (18%) |

| Gross profit (%) | 26.6 | 24.3 | 2.3% pts |

| Adjusted EBITDA | 524 274 | 391 651 | 34% |

| Adjusted EBITDA (%) | 10.1 | 5.7 | 4.3% pts |

COMMENTARY

- iOCO remains the core business of the Group, contributing 63% to total revenue. The continued rightsizing of the business, as well as the negative impact of COVID-19 on clients' IT expenditure, impacted the revenue size and growth profile of the iOCO business. Nonetheless, certain areas of the iOCO business have benefited from customers' increased migration to the cloud and increased spend on automation and application development.

- With regards to the International business, while contract delays in Egypt impacted performance, this was partially offset by strong performance in the UK and Switzerland.

- The business is now more stable and focused on margin enhancing product and service offerings as evidenced by the improvement in the gross profit and adjusted EBITDA margins to 26.6% (FY2020: 24.3%) and 10.1% (FY2020: 5.7%) respectively.

- The margin improvements for the year were due to a growth in our operational technologies' capability, a reduction in hardware sales, as well as the management of operating expenses and a focus on optimisation.

- iOCO digital remains a growth driver for the business with performance in line with expectations and some previously loss-making businesses within the iOCO Digital cluster became profit contributors over the course of the 2021 financial year.

- In addition, the public sector re-entry strategy has been mobilised and is yielding value with a solid pipeline.

- The iOCO business has seen positive momentum in new deals won with the signing of new multi-year annuity deals across both private and public sector clients. This is evidence of iOCO's position as the country's leading end-to-end technology solutions provider.

Digital transformation and automation

Digital innovation is at the heart of our 4 000+ strategic and technical specialists

Welcome to Nextopia

Nextopia is the world we imagine for our clients and their customers - a place we have created to help build a better South Africa for us all.

Nextopia is home to the digital enablement of infrastructure and people management services, delivered by our world-class, future-focused solutionists.

In Nextopia we solve together to positively shift the way people work and live, through our delivery of trusted fit-for-purpose technology and our ability to create authentic relationships with our clients.

At Nextopia we are a team. We embrace our distinctive talent, our entrepreneurial spirit and our wealth of experience to create a world that we are proud to be a part of and where we can make sustainable differences for all.

Infrastructure Solutions

72% of revenue

Infrastructure Solutions

28% of revenue

| FY2021 | FY2020 | ▲ | |

| Gross revenue (R'000) | 1 950 611 | 3 530 410 | (45%) |

|---|---|---|---|

| Gross profit | 355 557 | 527 266 | (33%) |

| Gross profit (%) | 18.2 | 14.9 | 3.3% pts |

| Adjusted EBITDA | (35 408) | (111 128) | 68% |

| Adjusted EBITDA (%) | (1.8) | (3.1) | 1.3% pts |

COMMENTARY

- NEXTEC contributes 24% to total revenue with the bulk of the segment revenue derived from the Infrastructure Solutions cluster.

- Despite the negative impact of COVID-19 and projects delays mainly affecting Infrastructure Solutions, a strong improvement in earnings across gross profit, EBITDA and operating profit was achieved due to the realisation of the benefits of the strategic interventions put in place by the new management teams, as well as the exit of underperforming business in the prior year.

- The NEXTEC People solutions business in particular, generated strong operating profit and EBITDA in the second half of the 2021 financial year with margins improving due to further efficiency gains and stringent cost control.

- The Digital Infrastructure cluster benefited from increased customer investment in digital technologies, particularly in the mining industry, but experienced contract delays in the consulting services predominantly across municipalities, the construction, water and energy sectors. Significant steps have been taken to materially reduce the expected losses to completion of the non-core businesses to be closed, namely PiA Solar and Autospec. Gross profit and adjusted EBITDA margins in NEXTEC improved to 18.2% (FY2020: 14.9%) and (1.8%) (FY2020: (3.1%) respectively.

- The NEXTEC businesses that remain core to EOH are self-sufficient from a liquidity perspective. NEXTEC's focus remains on quality of earnings, cash conversion and profitable growth as low margin projects are phased out.

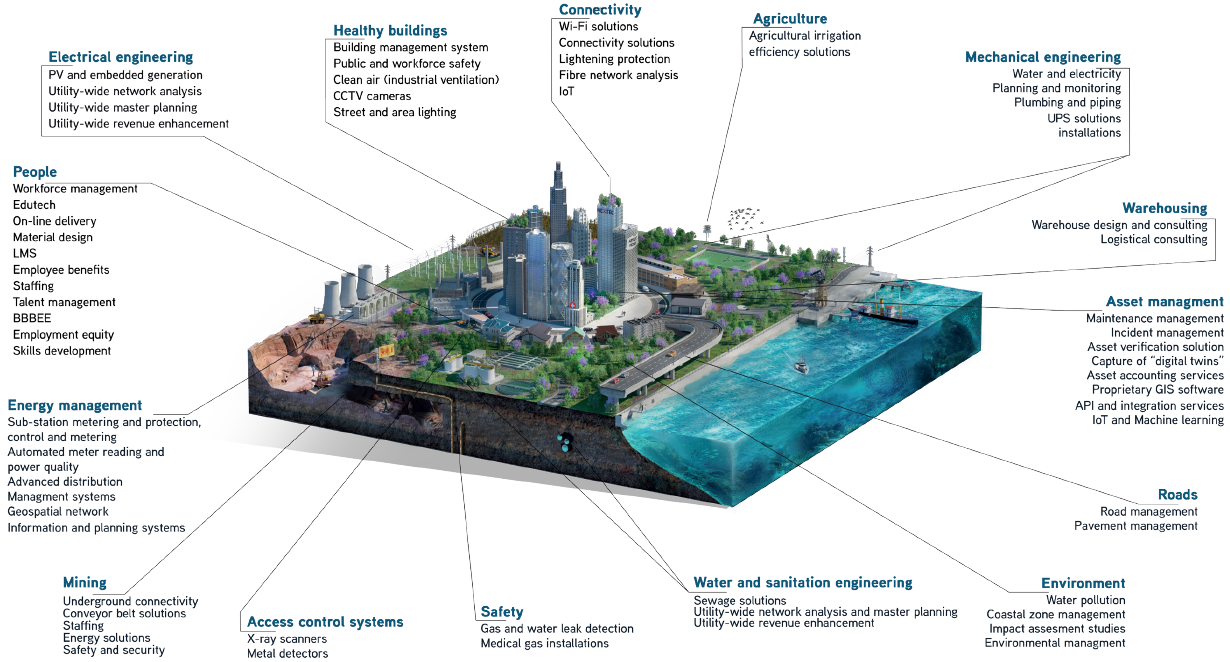

NEXTEC is one of the leading technology system integrators with best-in-class people solutions

Saved 52 megalitres of water for the City of Cape Town. That is 450 Olympic size swimming pools per month

Implemented smart estate security solutions into South Africa's largest residential estate

Provided 1 million + hours of online tutoring to mainland China in a year

Led Western Cape in designing a strategy to manage school and hospital assets

Provided engineering resources for projects in KwaZulu-Natal and Mpumalanga

Provided an environmental health survey in Lesotho

Provided smart electronic solutions, CCTV camera, security and WiFi, to the largest SA university

Designed and completed a 120 000m2 distribution centre. The largest in South Africa

Was the principal advisor to the first OEM (Automotive) to achieve Level 1 B-BBEE contributor status

Supplied a wireless mesh communication solution to a large global mining organisation

- Sold for a base price of R211 million in November 2020

- EV/PAT of 12.2x

- Sold for a base price of R334 million

- EV/PAT of 10.3x

- Sale not yet unconditional

INFORMATION

SERVICES

- In the process of being sold – late stages of negotiation

| FY2021 | FY2020 | ▲ | |

| Gross revenue (R'000) | 1 042 482 | 1 212 301 | (14%) |

|---|---|---|---|

| Gross profit | 603 851 | 480 722 | 25.6% |

| Gross profit (%) | 57.9 | 39.7 | 18.2% pts |

| Adjusted EBITDA | 266 876 | 267 133 | (0.1%) |

| Adjusted EBITDA (%) | 25.6 | 22.0 | 3.3% pts |

COMMENTARY

- The IP cluster performed well over the period. Following the sale of Syntell and Sybrin, the disposal process of the last remaining non-core IP asset, Information Systems, has advanced significantly and is expected to close before the calendar year end. Gross profit margins remained strong in the IP business at 57.9% and adjusted EBITDA margins of 25.6%.