report

Our operating context

COVID-19

The fourth industrial revolution has been accelerated by the global response to the COVID-19 pandemic. Digital solutions have become increasingly responsible for the way people connect on a social and economic level. While COVID-19 has led to an increase in some of EOH's offerings, including cloud uptake, automation and security, the negative impact on the economy has had a meaningful impact on our clients and therefore our ability to grow unencumbered.

In 2020, the ICT market in South Africa had an estimated value of R99 billion and was one of the fastest growing sectors in South Africa, with a pre-COVID-19 growth forecast of 8% year on year until 2023. Following the commencement of lockdown level 1 in 2020 due to COVID-19, the International Data Corporation ('IDC') estimated a 9% decline in the ICT market. In addition, the civil unrest that broke out in South Africa in July 2021 is expected to have some negative impact and as a result, the outlook at this stage is uncertain.

The ICT sector is positioned as a critically important sector in President Cyril Ramaphosa's growth plan for South Africa and a leading driver of job creation in South Africa1. The public sector is the single largest contributor to ICT spend in South Africa, comprising approximately 25% of the ICT market in 2020, while the private sector spend was hampered by the uncertainty created by COVID-19, with some clients deferring ICT spend in order to focus on liquidity. It is estimated that an overall decline of 2% in ICT spend is expected in the private sector, with public sector spend growing at 3.1% compound annual growth rate ('CAGR') through to 20222.

| 1 | Source: South African National Development Plan 2030 and South African National Integrated ICT Policy White Paper – August 2020 |

| 2 | Source: National Treasury ICT Budget Tables, June 2020 |

TRENDS AFFECTING OUR CLIENTS IN 2021-2022

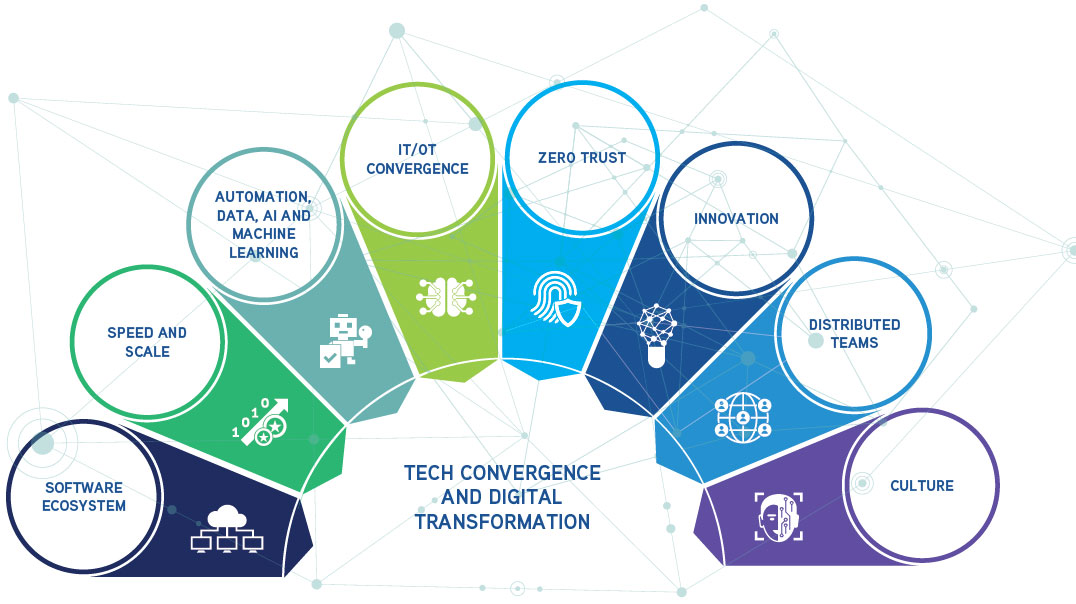

Our clients are heading into a world where the convergence of technologies is providing opportunities for technology companies such as EOH to add value:

Digital trends

IT/OT convergence: Information technology ('IT') and operational technology ('OT') convergence accelerated in recent years. The potential return on investment from advanced technology deployments in operations crossed a critical threshold and companies can no longer ignore the transformational opportunities they offer. Foundational enabling capabilities like data governance, cybersecurity, compute infrastructure and holistic and cohesive technology architectures – and the internal and external skills to support them – are all key focus areas for 2021 and beyond.

Source: IDC's Worldwide IT/OT Convergence 2021 Predictions

Automation, data, artificial intelligence ('AI') and machine learning ('ML'): Combining the right technologies to simplify, design, automate and manage processes across the organisation instead of using tools that are script-based and designed for narrow use cases, integration of ML and AI has proven to vastly improve operational discipline and performance, reveal business anomalies, generate valuable insights and optimise workloads. Organisations need to use ML to add an intelligent layer of automation to their business, using data to guide the automation strategy. Advanced analytics helps generate actionable insights about what will happen next, through both internal and customer-facing applications.

Speed and scale: All companies are looking for speed and scale in order to do more and get through digital roadmap projects faster. However, with limited skills and limited time, many clients move to a managed capacity model (where they outsource to a vendor a whole piece of work or hire an agile squad). Speed and scale need to be underpinned by competencies, centres of excellence and great recruitment.

Software ecosystem: Requires a platform on which extenders can build specific solutions to create complementary value and independent developers who can extend and enrich a platform while sharing costs and risks. The leading firm, or orchestrator, must promote the sustainable development of the ecosystem by defining strategies and orchestrating the activities of the various players. The orchestrator is responsible for managing the evolution of the enterprise architecture and the interactions among all actors within the ecosystem.

Zero trust: The zero-trust security model is reshaping the traditional approach to cybersecurity. No device or system should be trusted without verification, and even then, it should be regularly scanned for breaches. Since an increasing number of companies are reliant on third-party services and vendors, more than half have experienced security violations, as reported by the Cyentia Institute and RiskRecon.

Innovation: It is becoming fundamentally important for companies to recalibrate their organisations (change the way they do/think about things) and work on HOW they do it –

behaviour-driven design, UX/UI, info-driven architecture, DevOps and automated testing. The creation of this kind of ecosystem is rarely possible solely with in-house skills.

Distributed teams: Good tech skills such as developers, data engineers and architects are scarce. It is difficult to find and keep these skills and it takes a considerable amount of leadership time to interview and recruit. Retention is an important issue accompanied by long ramp-up times and insufficient industry/organisation knowledge. Companies can no longer rely on their own teams and need to cast the net much wider – there are no longer geographic boundaries to where skills can be sourced.

Culture: Post-COVID-19, there will be an increase in the number of employees working remotely, at least part-time, resulting in a shift to technologies that enable collaboration, improve the employee experience, engagement and performance goal-setting. This also comes with increased opportunities to use data to track, not only employee productivity, but employee engagement and wellbeing. A 2019 Gartner organisation design survey found that 55% of organisational redesigns focused on streamlining roles, supply chains and workflows to increase efficiency. While this approach captured efficiencies, it also created fragilities, as systems have no flexibility to respond to disruptions. Resilient organisations are better able to respond and correct course quickly with change.