About EOH

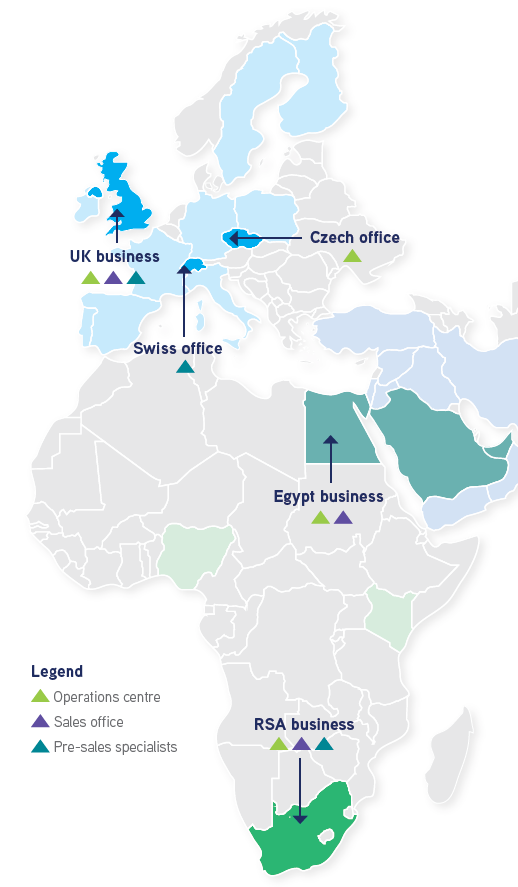

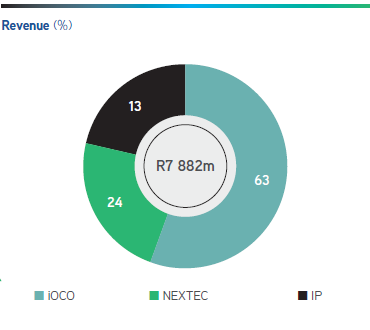

EOH is one of Africa's largest technology services providers covering the entire information and communication technology ('ICT') value chain including offerings in: IT-managed services, security, automation, cloud solutions, data and development capabilities, proprietary IT product resales, IT consulting and implementation services. The Group's geographic footprint extends across Africa, UK, Europe and the Middle East.

The Group continues to be a market leader in its core ICT business, which operates under the iOCO brand name and is an integral technology partner to a diversified client base of ~5 000 clients, including a number of leading JSE-listed, blue-chip companies, as well as key metros and government departments.

As a proudly South African business, EOH is committed to sustainable transformation, making a positive, meaningful contribution to society and is a Level 1 Broad-based Black Economic Empowerment ('B-BBEE') contributor.

EOH is also a premier partner to global technology providers – representing over 50 OEMs# with up to 500 partnership certifications. As a primarily services company, the Group's 5 986* employees are intrinsic to its ability to deliver world-class services to customers across all major industries throughout South Africa.

# Original Equipment Manufacturers

* Excluding ~3 600 contractors

One of Africa’s largest technology services companies

5 000+ Enterprise customers

LEVEL 1 B-BBEE contributor

Growing

International Footprint UK, Middle East and Europe

Key Technology Partner for leading companies

DIGITAL

TRANSFORMATION

THE EOH BUSINESS COMPRISES TWO KEY BUSINESS SEGMENTS OFFERING DIFFERENTIATED VALUE PROPOSITIONS

A diverse set of businesses focused on people outsourcing solutions and intelligent infrastructure at various stages of incubation for growth and scaling.

INFRASTRUCTURE SOLUTIONS

Comprises two services: Digital Infrastructure and Infrastructure Consulting. Both operate across sub-Saharan Africa and leverage off deep domain expertise and the integration of global best practice and technology.

PEOPLE SOLUTIONS

Supplies solutions around recruitment, staffing, training and development

ICT business focused on traditional and cutting-edge technology systems integration, with a range of solutions, products and services across the ICT value chain.

SALES & ADVISORY

- Go-To-Market

- Solutioning

iOCO SERVICES

- Network Solutions

- Management & Operate

- Digital Industries

- Knowledge Process Outsourcing

iOCO TECHNOLOGY

- Computer Software Reseller

- Enterprise Applications

- Computer Hardware Reseller

iOCO DIGITAL

- Application Development

- Data Analysis

- Cloud & Security

- International

- Automation

A group of high-potential IP companies with scalable technology. These businesses were identified for disposal as part of EOH's deleveraging strategy which is substantially complete. Syntell was sold in November 2020 while the Sybrin sale was announced in June 2021 but is not yet unconditional.

INFORMATION

SERVICES

OUR GROUP PURPOSE

In a world where rapidly changing technologies are altering the course of humanity, our purpose is what defines us, reverberating deep within our core. Our purpose evokes pride, integrity and innovation in everything we do and moves us towards a sustainable and transformative future.

Our purpose is to SOLVE – for our people, our clients and our communities.

OUR VALUES

2021 PERFORMANCE REVIEW

SALIENT FEATURES FOR THE YEAR

- Generated an operating profit of R147 million for FY2021 before normalisation adjustments following a R1.3 billion loss in FY2020

- An improvement of 96% to the previously reported total headline loss per share from 534 cents (restated) to 22 cents

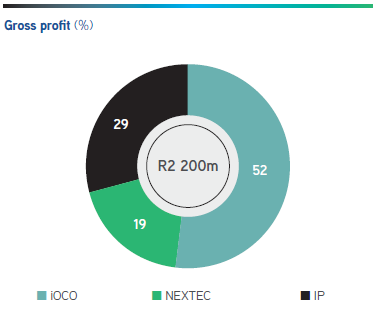

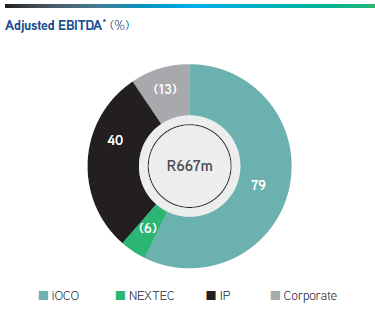

- Significant improvement in gross profit, adjusted EBITDA and operating profit margins due to rightsizing and focus on quality of earnings

- Significantly reduced one-off costs with meaningful progress made in working through inherited legacy issues

- Net working capital stable at R263 million in spite of a tough economic environment

- Positive momentum in new deals in public and private sector postremediation

| * | Adjusted EBITDA is defined as profit/(loss) before depreciation, amortisation, share-based payment expense, gain/loss on disposal of subsidiaries and equity-accounted investments, impairments of non-financial assets, share of profit/loss of equity-accounted investments, remeasurement gain/losses on vendors for acquisition liability, interest income, interest expense and current and deferred tax. |

Our strategic journey is shifting toward growth

Legend

Credibility

Closing out inherited legacy issues

Liquidity

Refining and revising capital and corporate structure

Transparency

Clarify and streamline business portfolio; position for growth

January 2020

New exco members with ICT experience

April 2020

Sale of remaining 30% stake in CCS

May 2020

Deleverage milestone: R1.8bn paid to lenders since August 2018

June 2020

First growth strategy plan in place

July 2020

R1.4bn total consideration since disposals process started in FY2019

90% improvement in net working capital investment since H2 2018

November 2020

Sale of Syntell

R1.66bn total consideration from disposals process since FY2019

Unqualified PwC audit

June 2021

Sybrin disposal announced (sale not yet unconditional)

NEXTEC turnaround substantially complete with core businesses generating positive EBITDA

Public sector integrated into core business

July 2021

Appointment of a Chief Commercial Officer from a large international OEM with extensive ICT experience

Formation of a robust commercial Go-To-Market function

FY2021+

Executing growth strategy