report

Chief Financial Officer's report

Megan Pydigadu Group Chief Financial Officer

EOH's significant progress since the start of our turnaround plan implemented three years ago in order to rectify the inherited legacy issues, is evident in the greatly improved financial results for the year to 31 July 2021. Gross margin continues to improve and the Group achieved an operating profit of R147 million from continuing and discontinued operations after posting a R1.3 billion loss in the prior year. Debt has declined significantly since 2018, although not as fast as we would have liked. Reducing the debt burden remains a critical focus for the management team. Cash management has been a highlight, especially considering the current economic climate, with excellent discipline in managing net working capital supporting improved liquidity.

The underlying effort and commitment from everyone in the EOH team to deliver this turnaround arises from the broader sense of purpose in the Group to not only turn the business around but also to transform it into a force-for-good that makes a difference in the broader society.

The finance function has a key role to play in ensuring that the business conducts itself ethically and with appropriate regard for the greater good. Conscious capitalism is about choosing who you do business with, ensuring sustainable margins, creating opportunities for employment, enabling our people to develop their full potential through upskilling, and ensuring transparency in the numbers reported. Business does not exist in a vacuum and it is critical that we tackle our socio-economic issues to ensure we have a sustainable business.

Now more than ever, it is critical that business embraces its role in society by partnering with government and civil society, by uplifting communities, developing skills and creating employment, thus ensuring a sustainable and thriving economy.

Finance sits at the core of business and plays a key role as both a strategic enabler and as the objective voice in the room.

As a finance function we are embracing the digitisation and automation acceleration through our business systems optimisation project (SpaceX). This will ensure automation in our shared service functions and ensure we leverage off the latest cloud technologies. This is underpinned by a single target operating model and will ensure consistent processes across the organisation underpinning a single data strategy.

Priorities – 2022 and beyond

Improving quality of earnings

As part of our path to deleverage and create a sustainable capital structure for the business, we have focused on exiting non-performing, non-core and certain IP businesses. We have simultaneously focused on doing good business with the requisite margins that ultimately deliver shareholder value. These deliberate measures have resulted in total revenue decreasing to R7 882 million in FY2021 from R11 277 million in FY2020. Business disposals and the close-out of loss-making legacy contracts accounted for approximately 75% of the revenue decline. Our base revenue (total revenue excluding the impacts of the legacy issues clean-up, as well as liquidated and sold assets) decreased by 11% to R7 201 million in FY2021 from R8 145 million in FY2020. Approximately R740 million of the decline in base revenue was due to reduced hardware sales as customers delayed spend on large, planned IT projects with the move to the cloud gathering pace; and the impact of COVID-19 on our clients in the education and human capital, beverage, travel and health sectors.

The Group's focus on quality of earnings and continual improvement resulted in a significant improvement in gross profit, adjusted EBITDA and operating profit margins. This is an indication that our strategy of doing good business is paying off

- Gross profit margins have increased from 20% in FY2019 to 28% in FY2021.

- Operating margins have increased from a negative 29% in FY2019 to 2% in FY2021

- Adjusted EBITDA margins have increased from -9% in FY2019 to 8% in FY2021

External revenue (Rm)

Historically, the Group reported on core normalised EBITDA which has stripped out once-off items and non-core business lines to be closed. The Group's normalisation adjustments have decreased materially in FY2021, resulting in a negligible difference between core normalised EBITDA and adjusted EBITDA. Consequently, EOH will guide the market on adjusted EBITDA as a performance measure going forward.

Decline in adjustments as business stabilises

An ongoing focus on costs

We have maintained our focus on creating an anti-fragile business by prioritising cost management and ensuring that our cost structure remains appropriate, agile and responsive to changing market conditions. Total operating expenses decreased by 46% to R2 053 million in FY2021 (FY2020: R3 788 million), as the remaining legacy issues were closed out and the benefits of cost-saving initiatives were realised.

Positive JAWS* resulting in operating profit

Cash versus non-cash opex(Rm)

Cash cost base remaining after disposals and legacy clean-up (Rm)

* The Jaws ratio demonstrates the extent to which the income growth rate exceeds expenses growth rate.

From a property portfolio perspective, most of our leases expire in 2023, which is when we expect to optimise our property portfolio. Cost reductions have continued across the major expense categories such as travel, marketing and administrative expenses.

For the first time since the Group embarked on its turnaround plan, EOH moved into a positive operating profit from continuing and discontinued operations of R147 million in FY2021 from an operating loss of R1 319 million in FY2020.

Adjusted EBITDA (from continuing and discontinued operations) for the year was R667 million compared to R19 million in FY2020. Adjusted EBITDA margin improved from 0.2% in FY2020 to 8.5%, which is in line with our stated target of achieving a 10% margin in the medium term.

Total headline loss per share from continuing and discontinued operations improved by 96% with losses reducing to 22 cents from 534 cents in FY2020. The ongoing headline loss is largely due to the Group's over-indebted capital structure and inefficient legal entity structure, which the management team continues to address as a core focus area.

Cash management and liquidity

The increased financial discipline includes a sharp focus on working capital management as part of overall liquidity management. While we have continued to manage collection closely in the current economic climate, the net investment in working capital has increased to R263 million at the end of FY2021 from R175 million in FY2020, which is still within our expected range. Looking at the long-term trend, we have reduced investment in working capital by 83% from R1 549 million in FY2018.

We have also seen an improvement in our credit risk with our expected credit loss provisions decreasing from 18% in FY2020 to 15% in FY2021 and our debtors' days remaining stable in the region of 65 days.

Net working capital stable in a tough environment

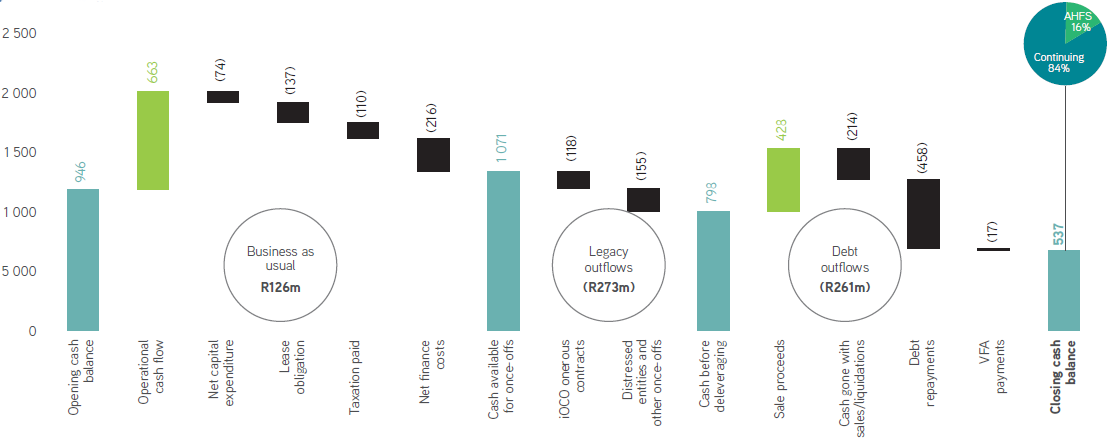

Our focus on working capital and liquidity management has resulted in strong cash generation from operations at R663 million (adjusted legacy outflow) - and an EBITDA cash conversion rate close to 100%. From a business-as-usual perspective, the Group contributed R126 million of cash after paying finance costs, tax, capital expenditure and lease payments and incurred R273 million of legacy cash outflows related to the iOCO legacy public sector contracts (that are now all closed out) and the two Nextec engineering, procurement and construction ('EPC') contracts.

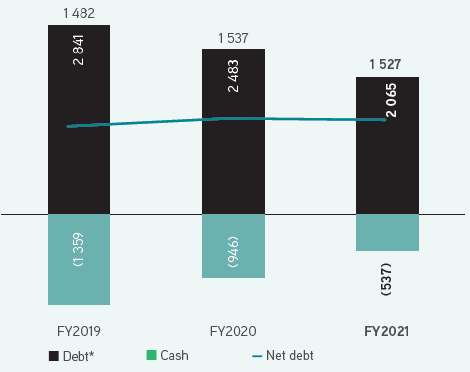

The Group had a net inflow of R214 million (after cash given up) from the disposal of subsidiaries and repaid lenders (including VFAs) R475 million and finished the year on R537 million of net cash with overdraft facilities of R400 million.

Further disposals will reduce debt and enhance capital structure

Following the disposal of Syntell in November 2020 for a consideration of R211 million, EOH concluded the disposal of Sybrin in June 2021 for a base cash consideration of R334 million. The deal is currently awaiting competition approvals in various African countries. Once these are concluded, the cash from the sale is expected to flow before the end of the 2021 calendar year. While disposals have been necessary as part of the deleverage strategy, management has always maintained that it would only conclude disposals if the valuations made sense, which is evidenced by the average EV/PAT multiples achieved on previous transactions.

The Group's current gross debt balance stands at c.R2 billion for FY2021 down from c.R2.4 billion in FY2020. Reducing the core legacy debt and the finalisation of the long-term overall capital structure remains a business imperative.

Good progress has been made on this front# with the lenders into the conclusion of a common terms' agreement structured into a R500 million three-year senior term loan facility and a R1.5 billion bridge facility repayable on 31 October 2022. During the year, the Group repaid lenders a further R433 million, principally from disposal proceeds. Conclusion of the sales of the remaining IP assets will further reduce the Group's debt to a more manageable level.

| Disposal | Industry | Financial year |

Enterprise value R’m |

Cash proceeds received R’m |

Cash proceeds to be received R’m |

EV/PAT multiple |

|

|

|

|

|

|

|

| CCS - 70% | Construction software | FY2019 | 651 | 444 | - | 19.2 |

| CCS - 30% | Construction software | FY2020 | 476 | 143 | - | 14.0 |

| DENIS | Dental health fund administrators | FY2021 | 250 | 224 | 17 | 7.2 |

| Syntell | Traffic management IP | FY2021 | 207 | 175 | - | 12.2 |

| Sybrin | Fintech | FY2022* | 410 | - | 334 | 10.3 |

| 986 | 351 | |||||

* Transaction expected to close in first half of FY2022

# Enterprise value post debt

Debt (Rm)

Outlook

As we look forward, our focus remains on building on the turnaround strategy we embarked on over the last two and a half years. We are now in a position to focus on delivering on our growth strategy and take advantage of the Fourth Industrial Revolution ('4IR'). We will continue to focus on doing good business at good margins, with a razor focus on costs and closing out our long-term capital structure.

Megan Pydigadu

Chief Financial Officer